- View All

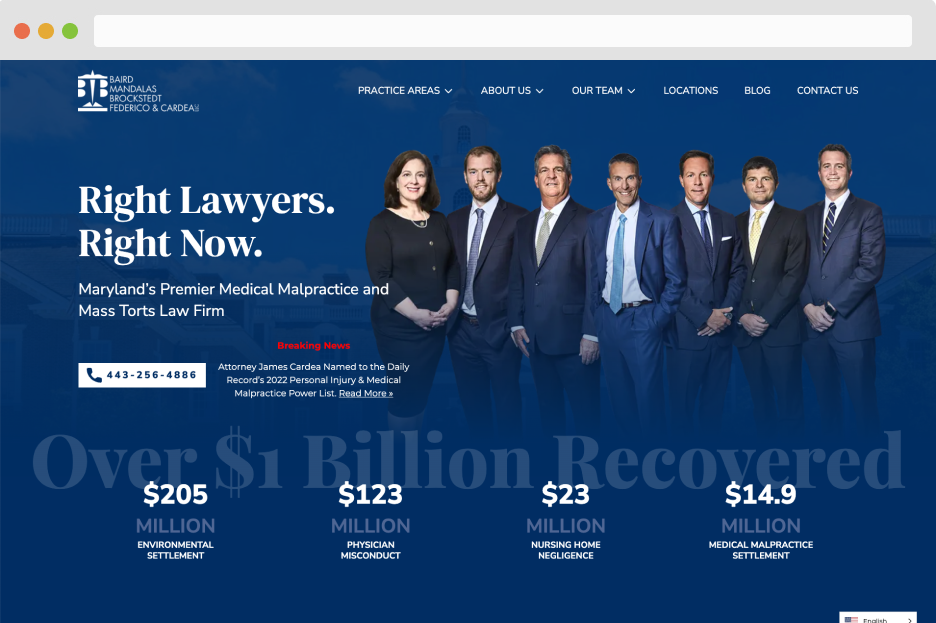

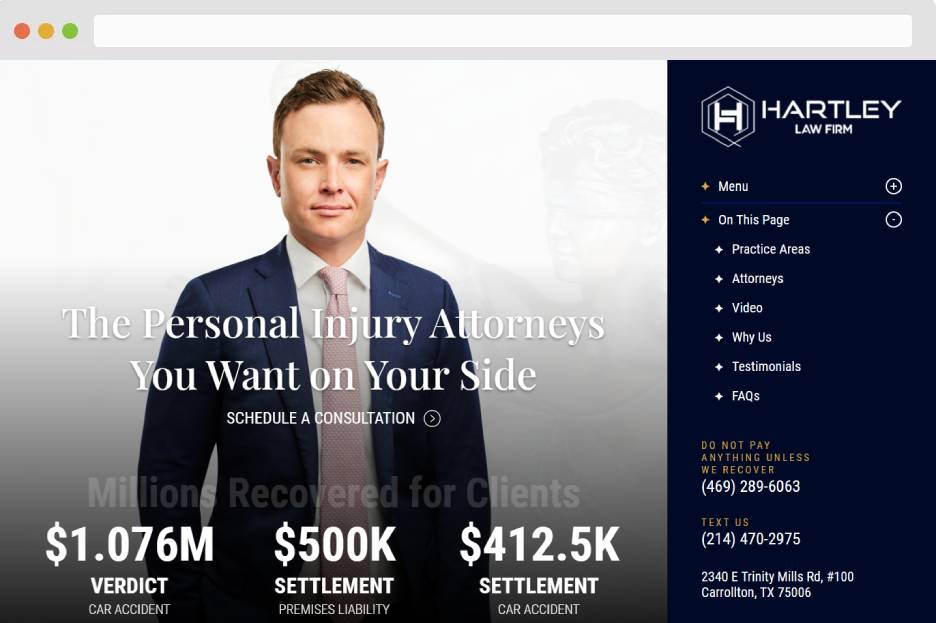

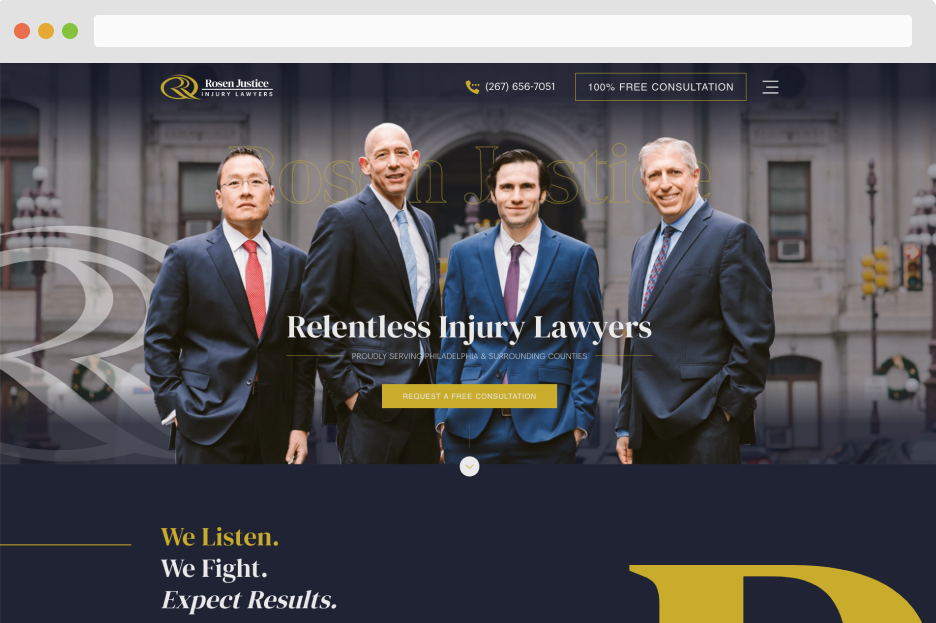

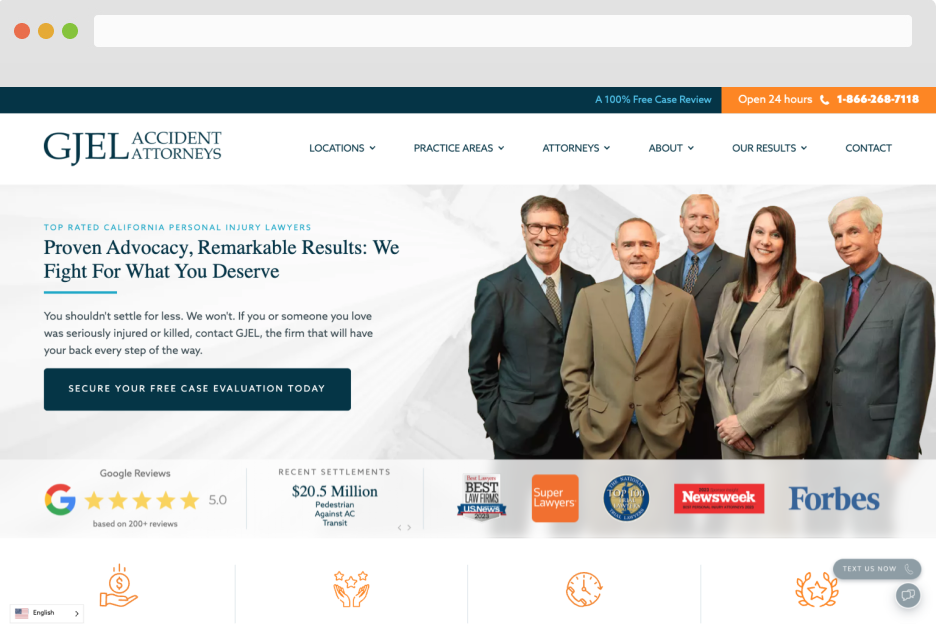

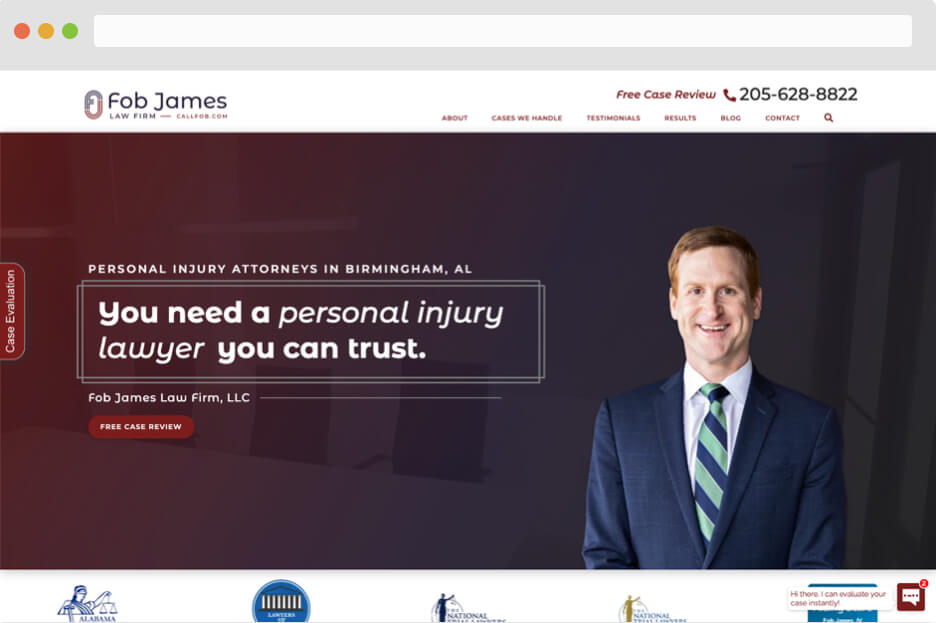

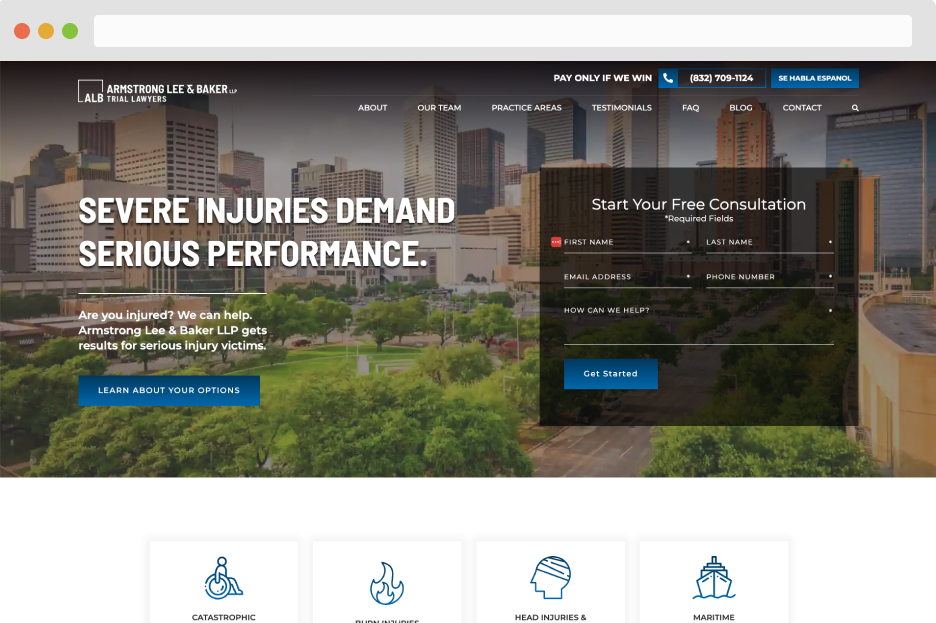

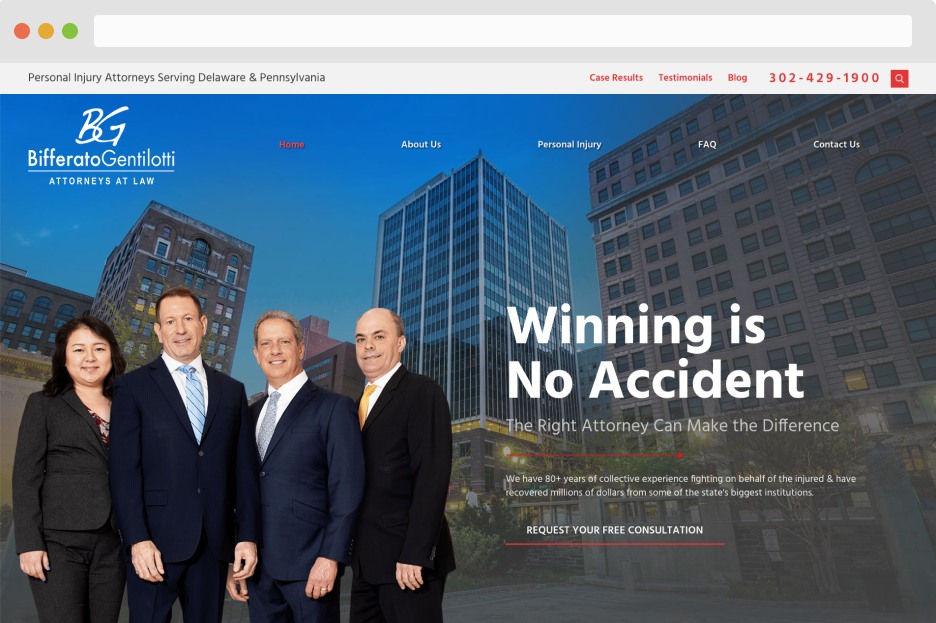

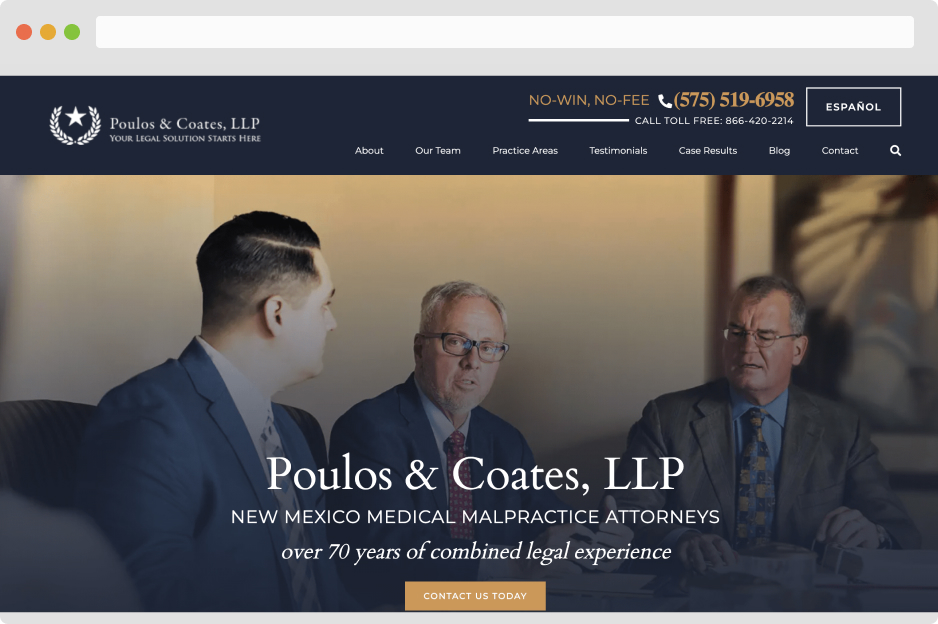

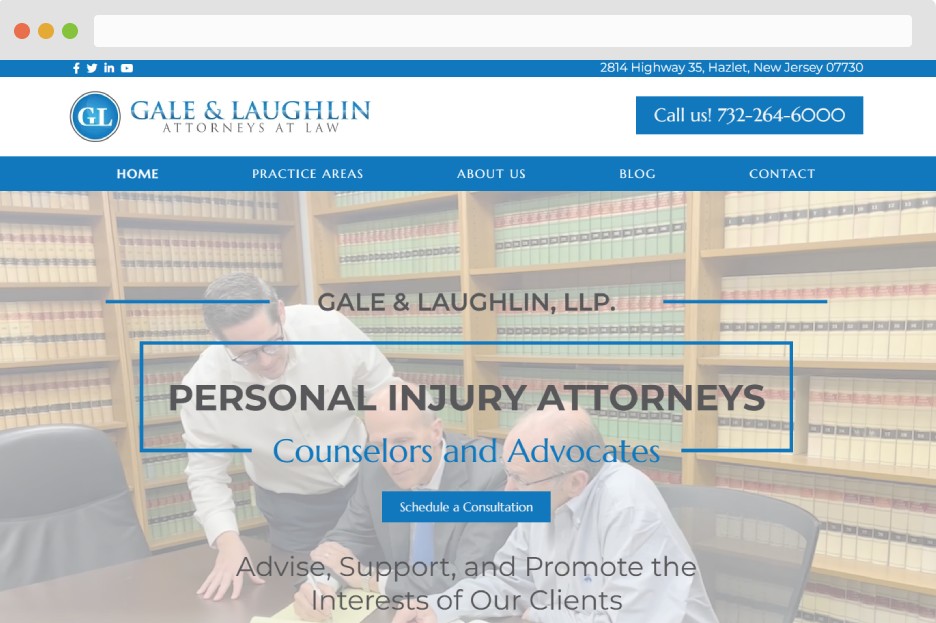

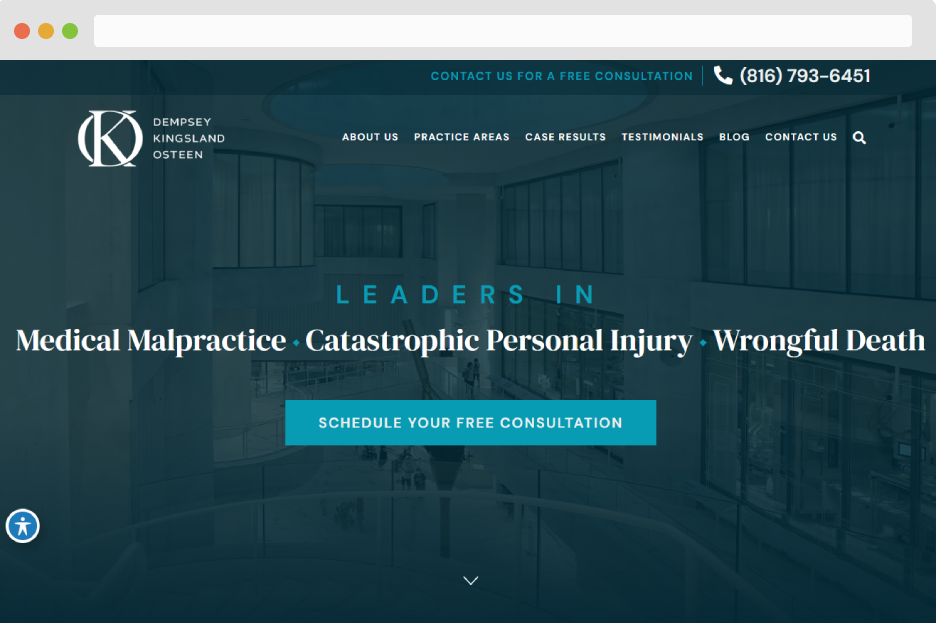

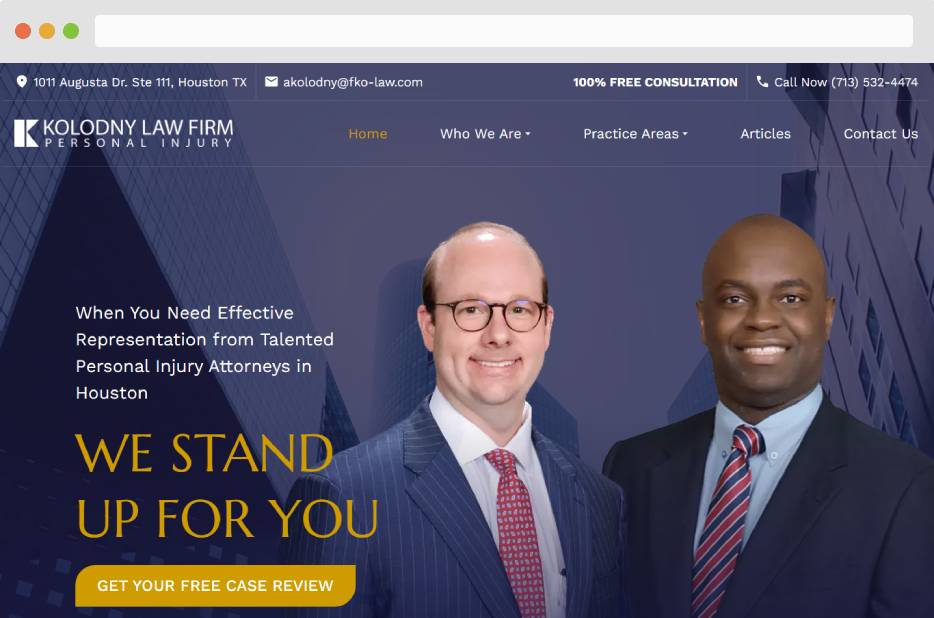

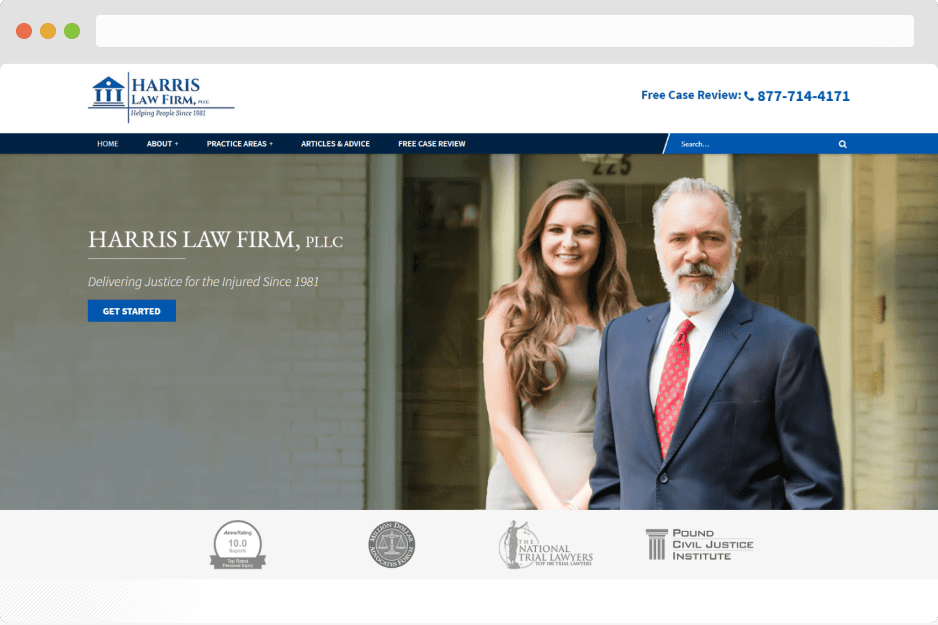

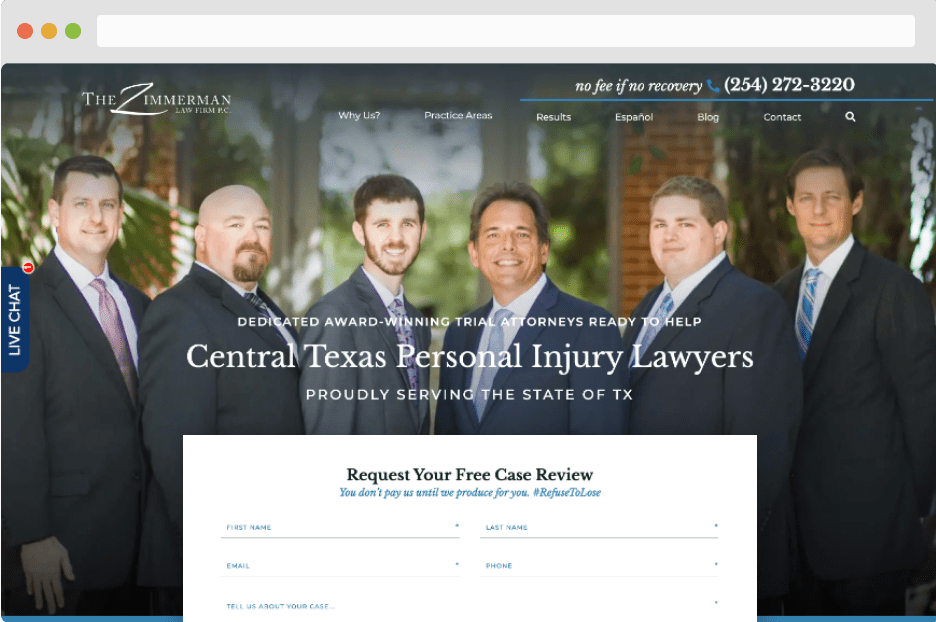

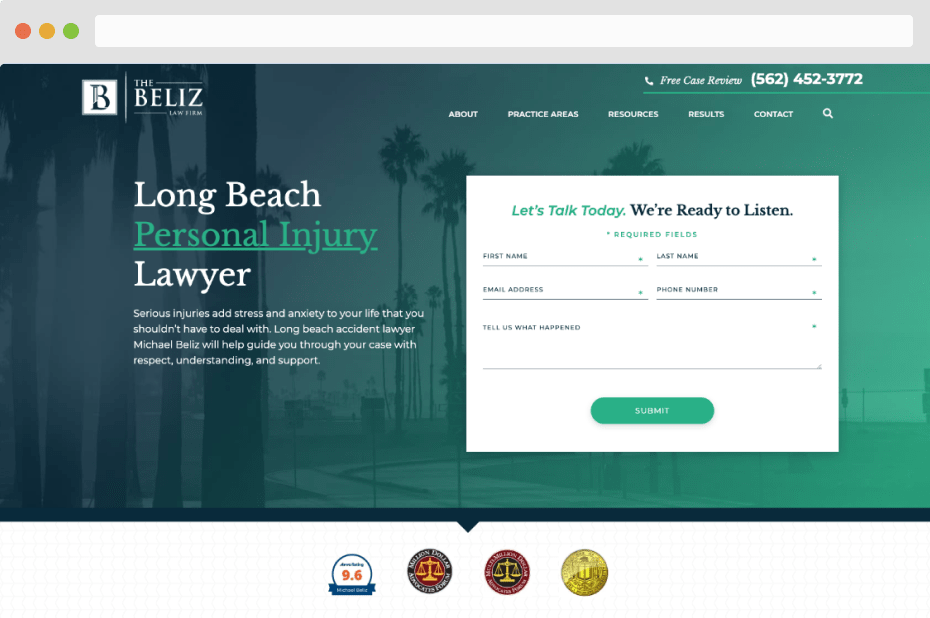

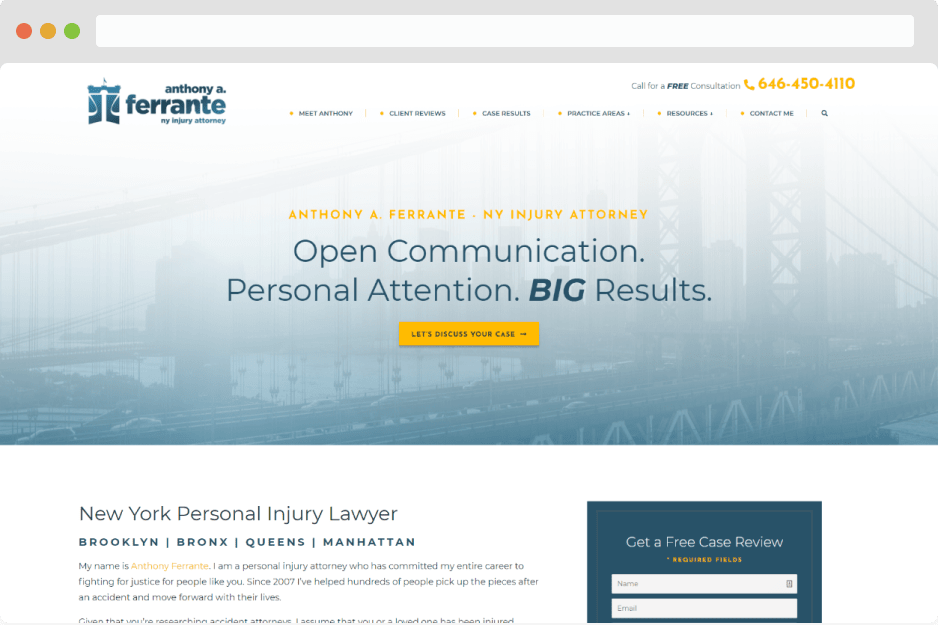

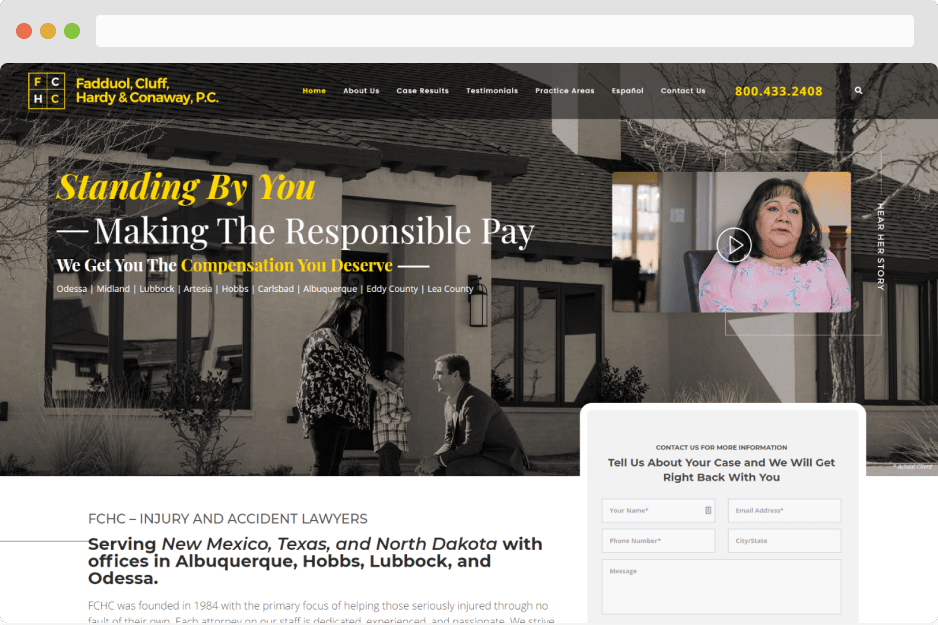

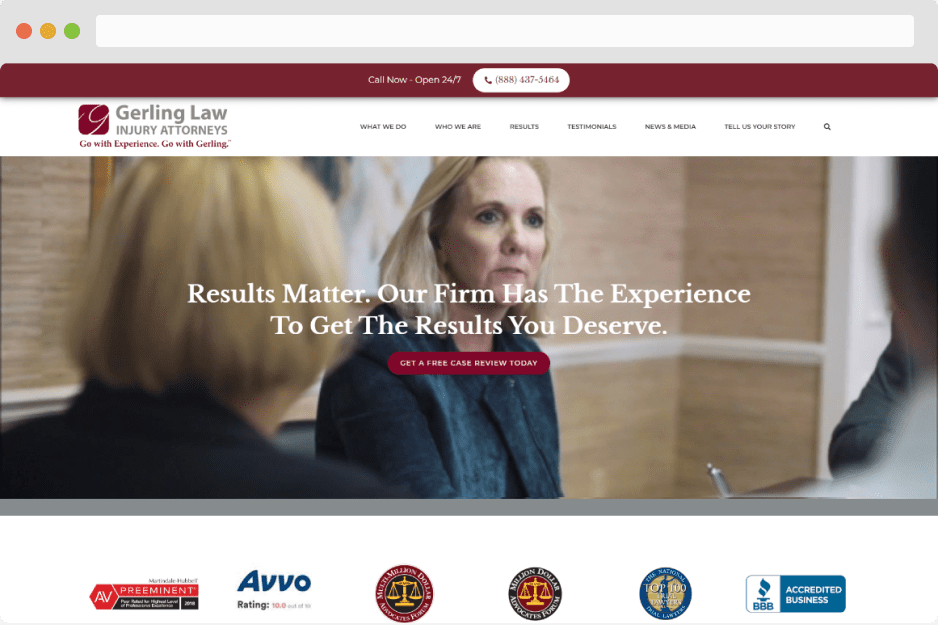

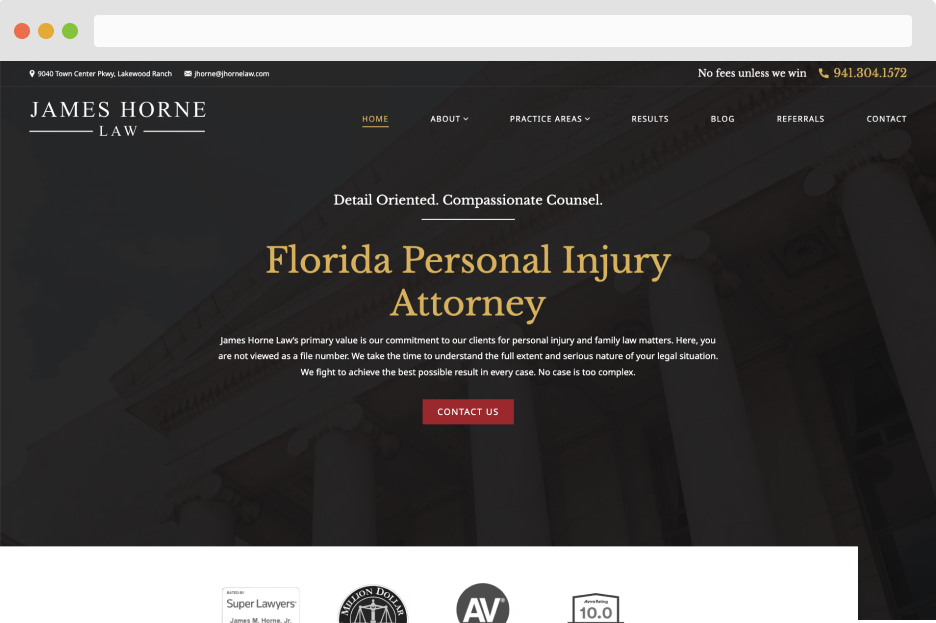

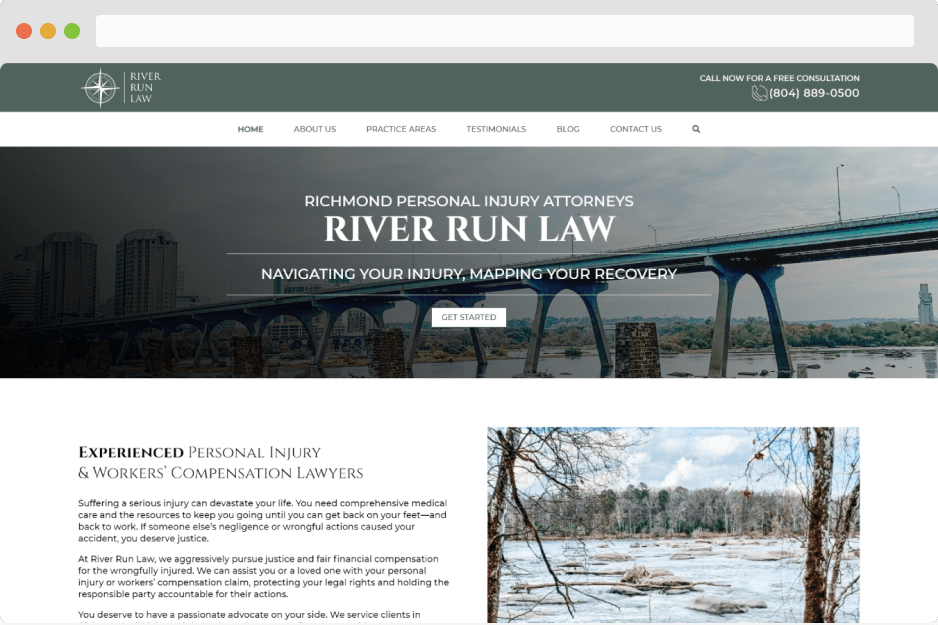

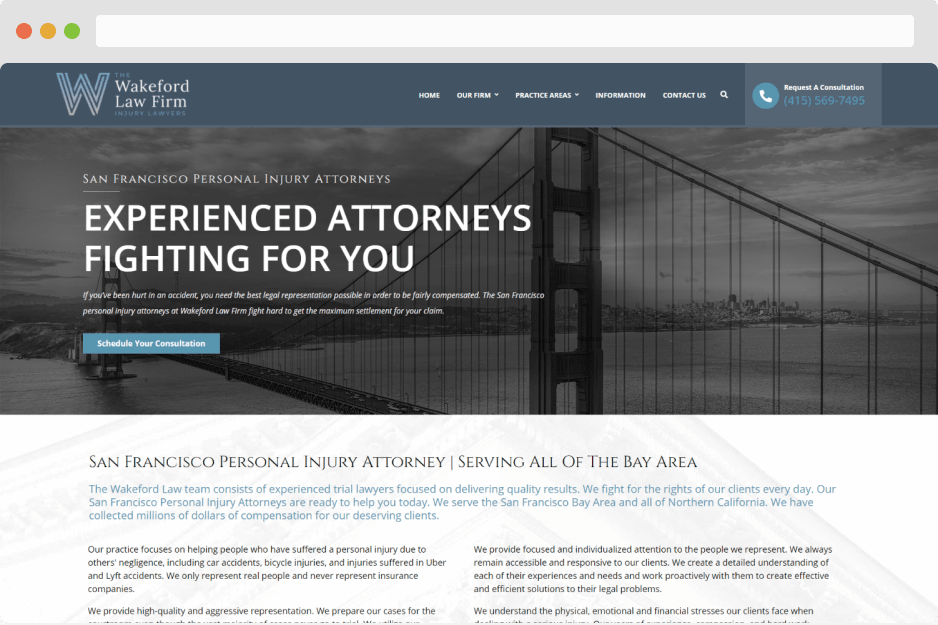

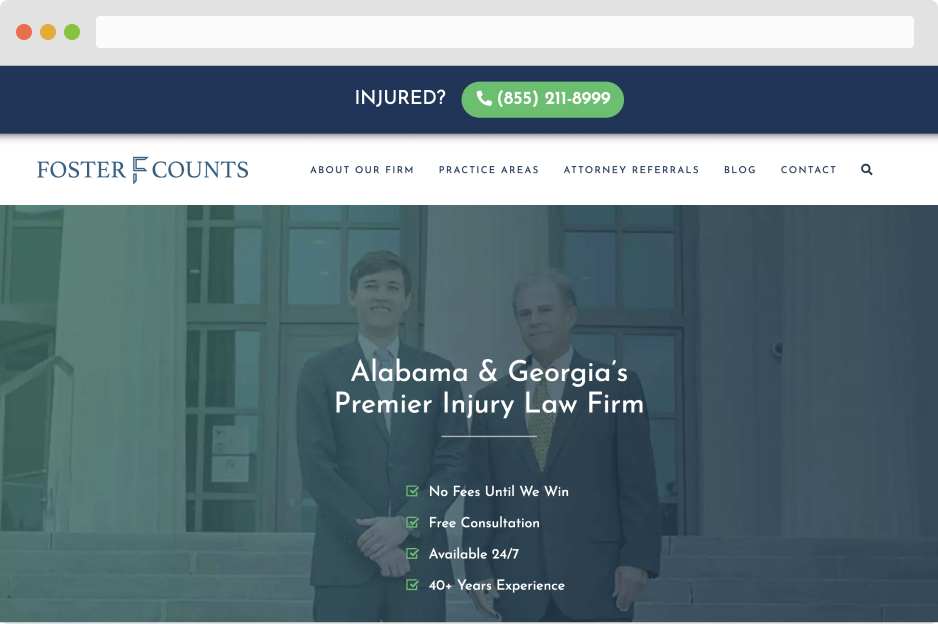

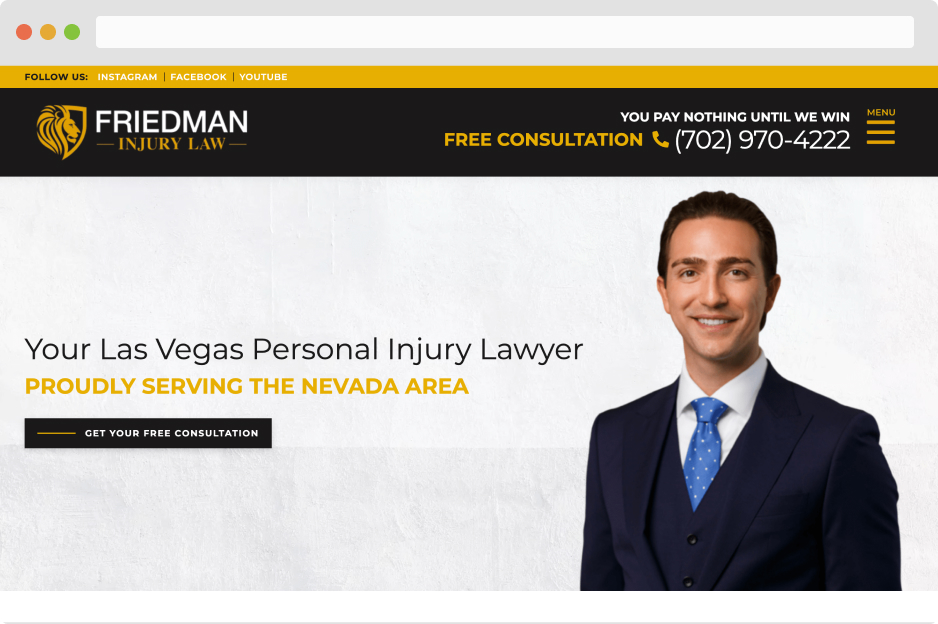

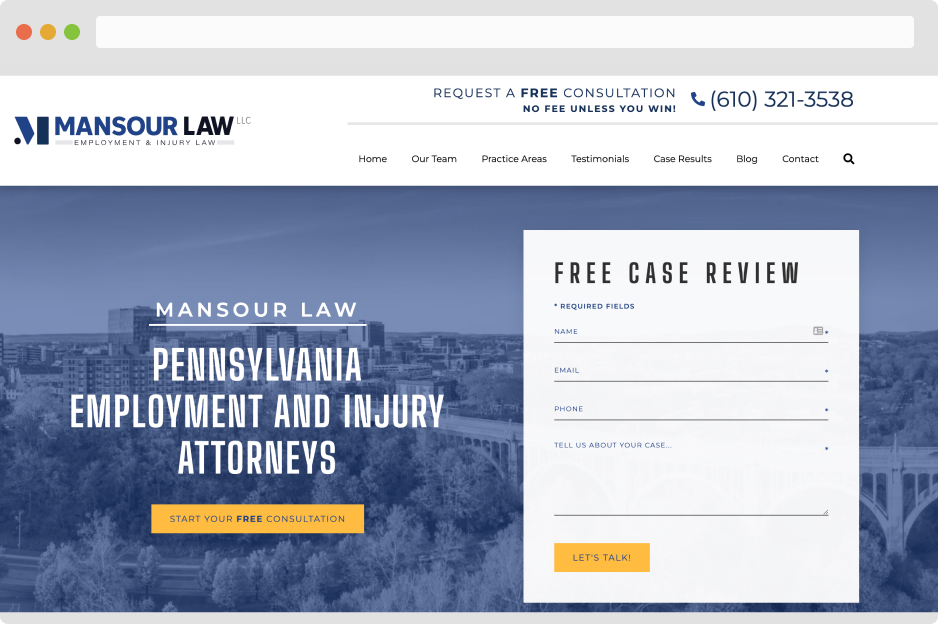

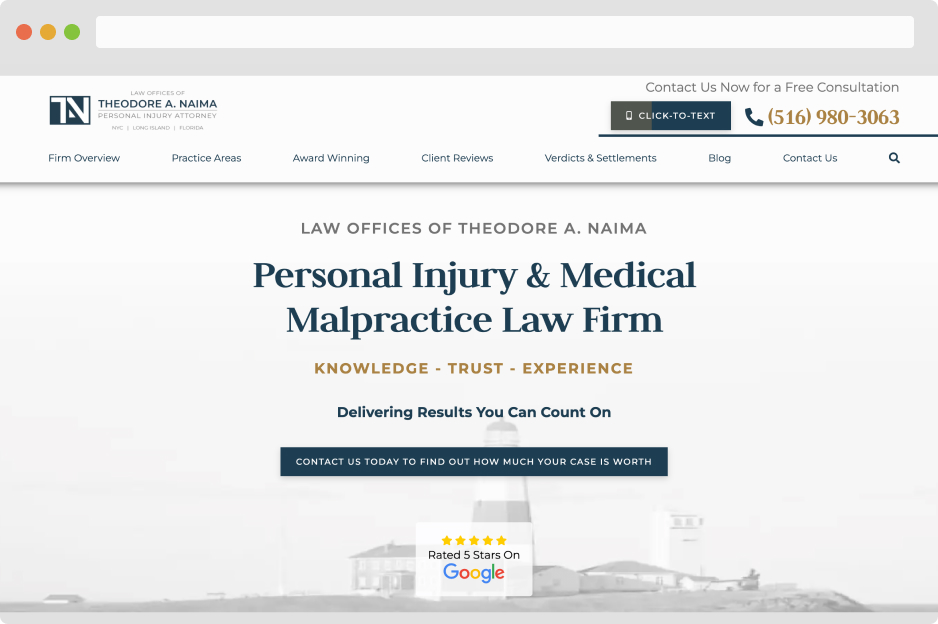

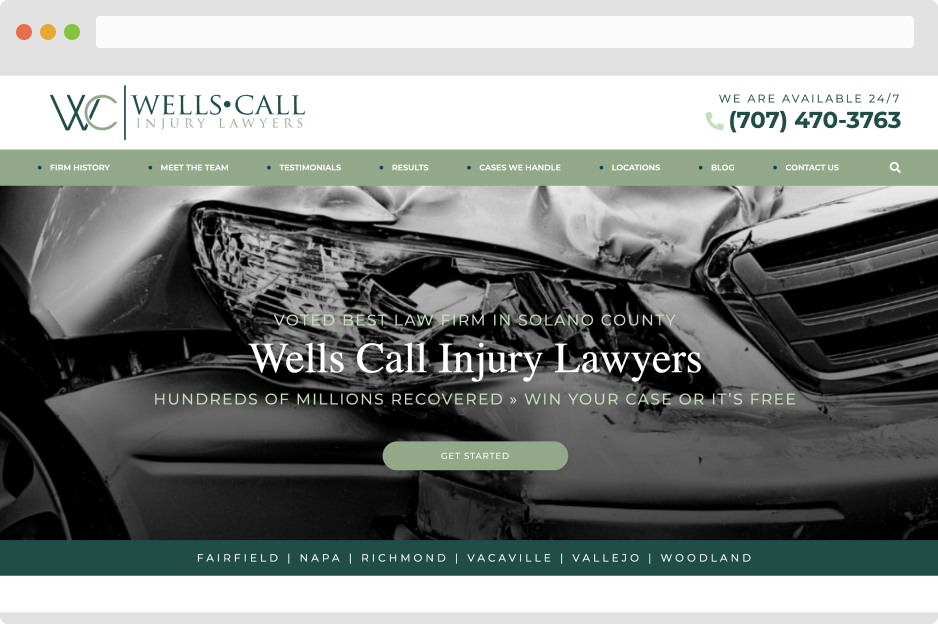

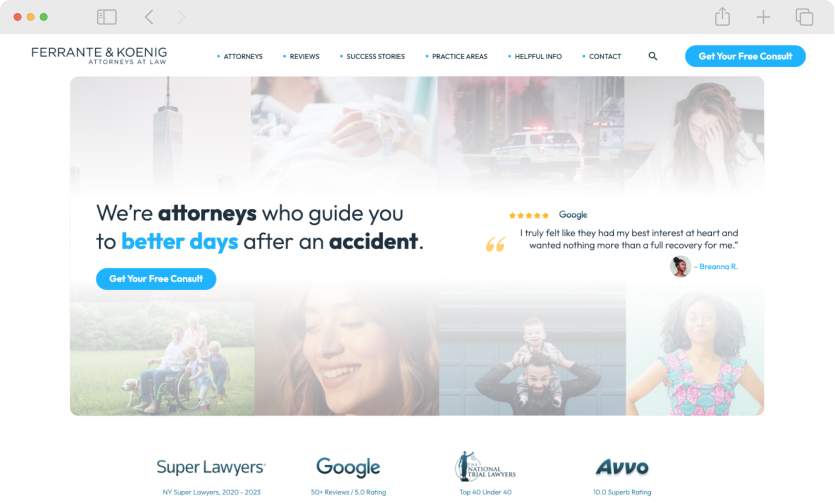

- Personal Injury

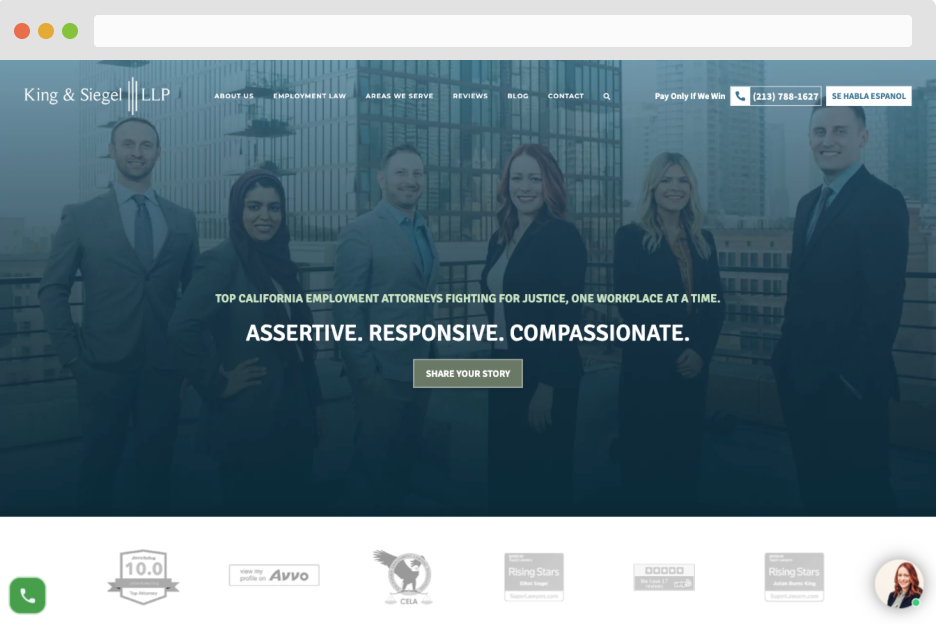

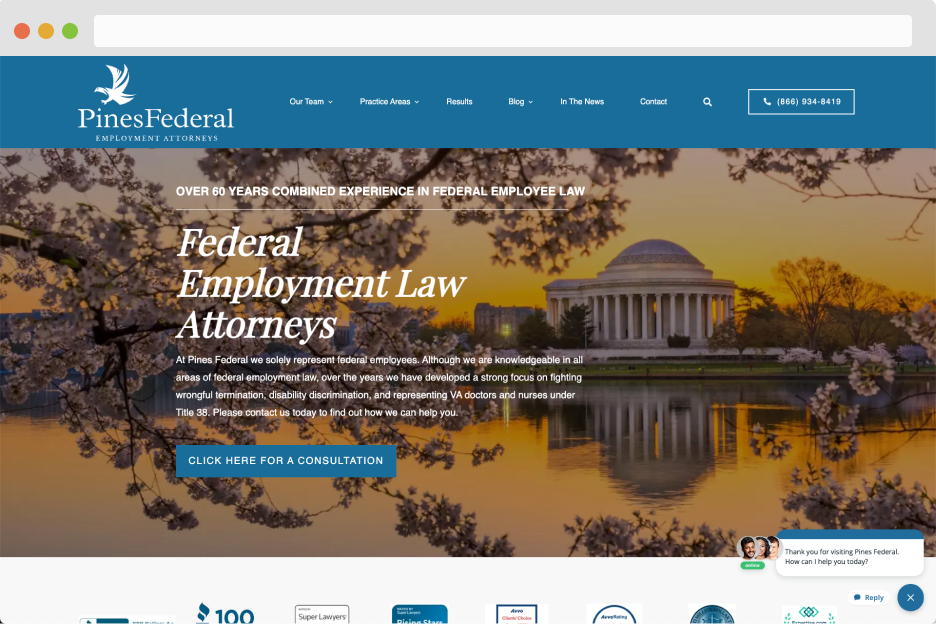

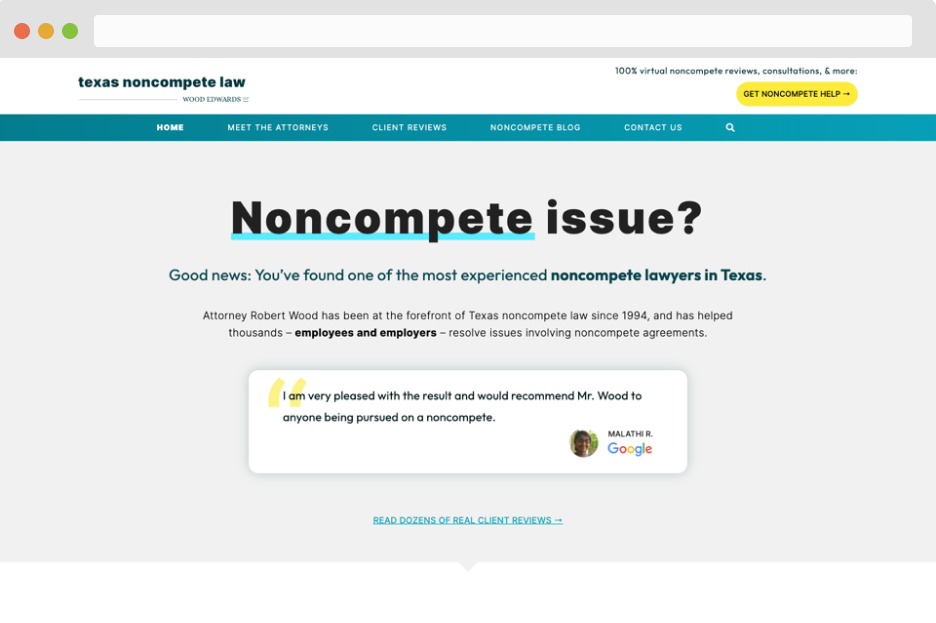

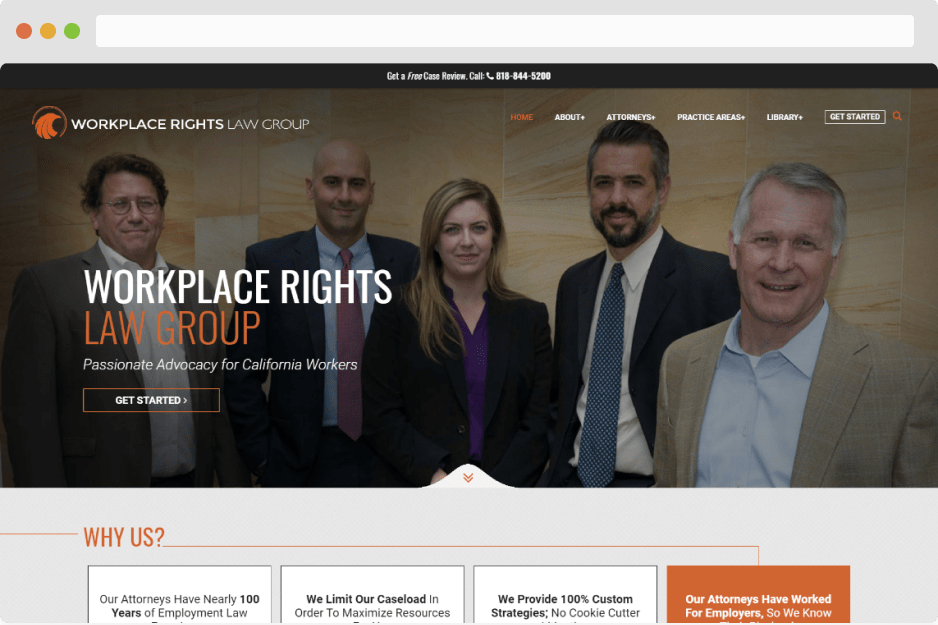

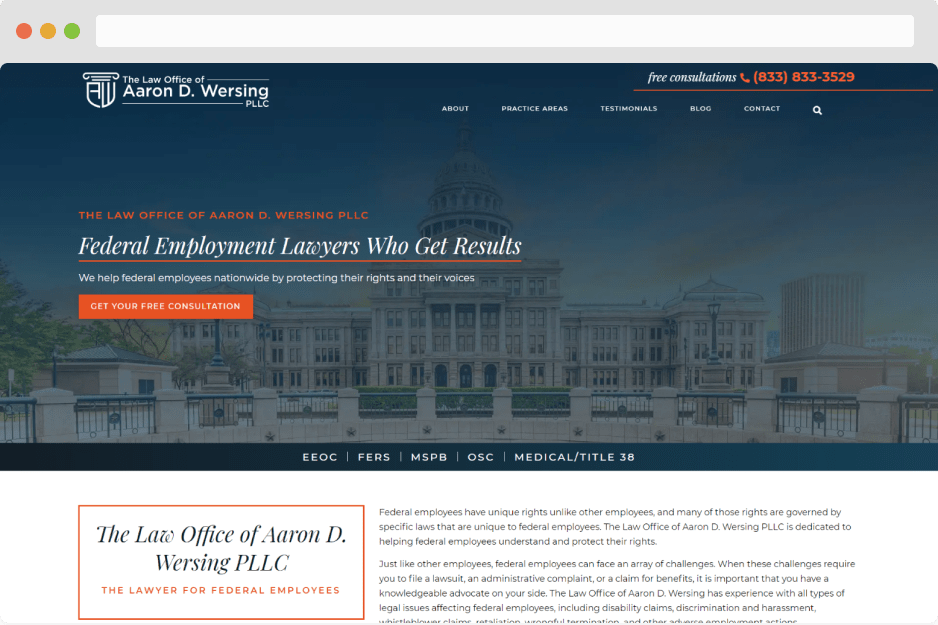

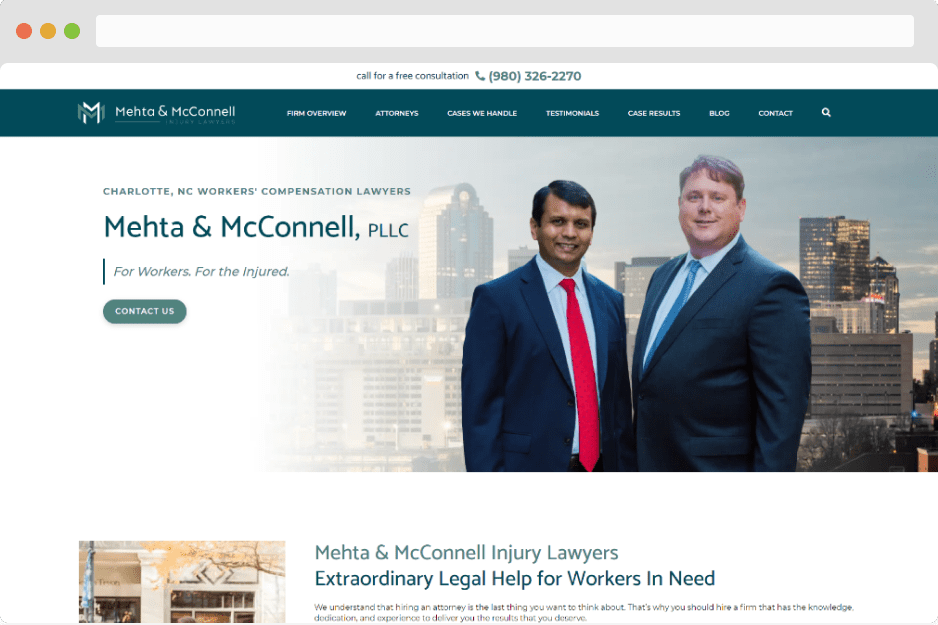

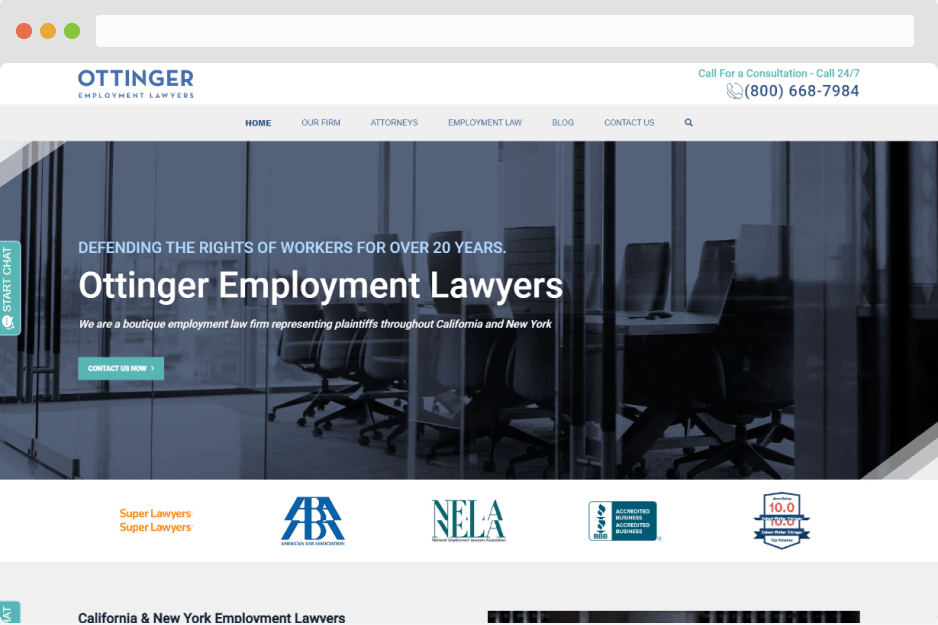

- Employment Law

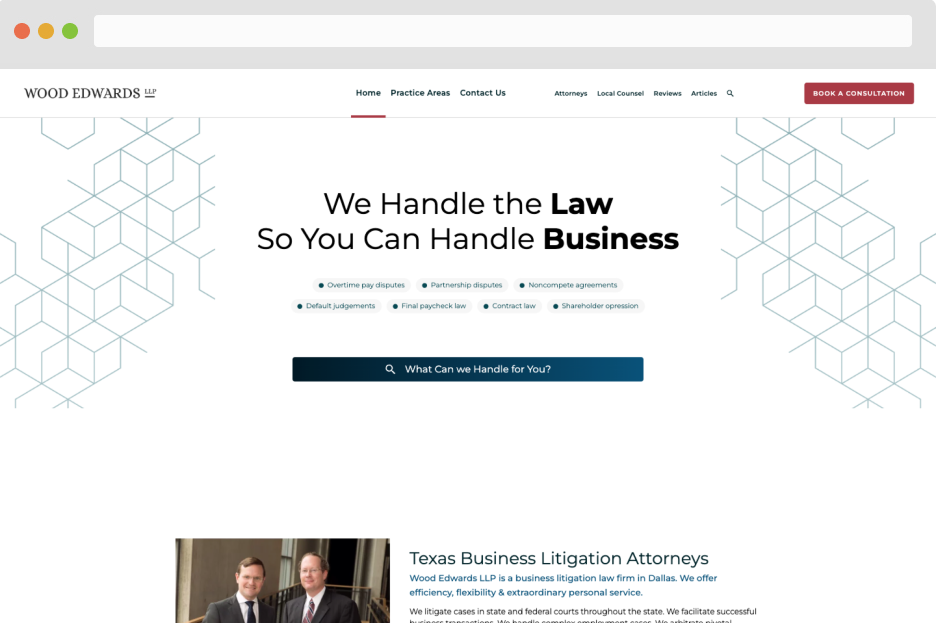

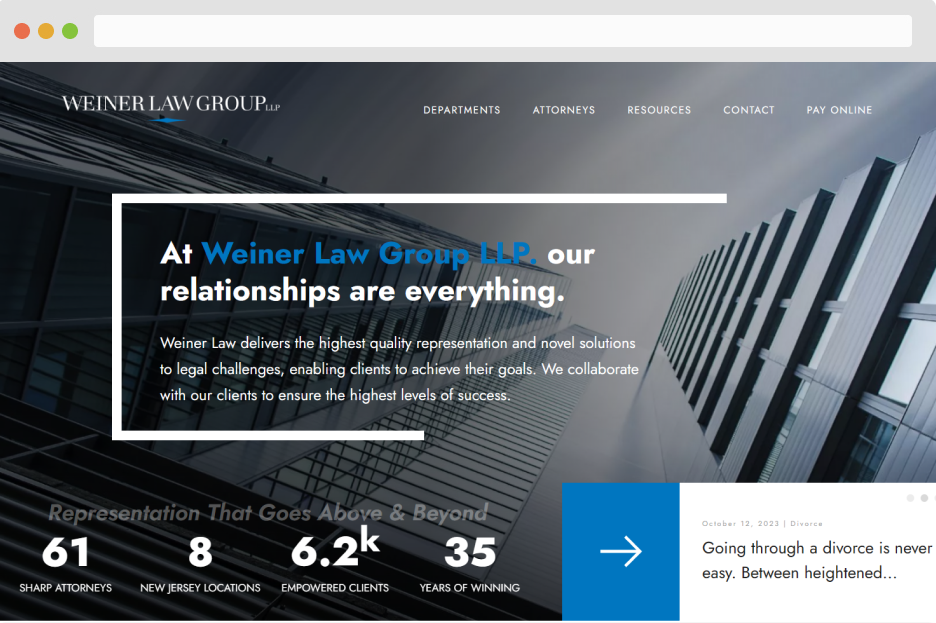

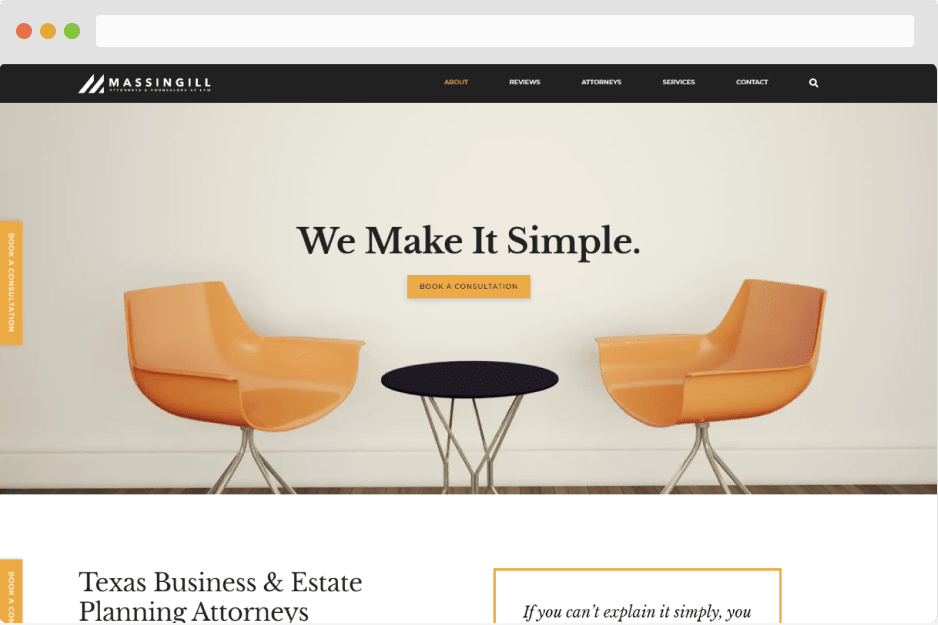

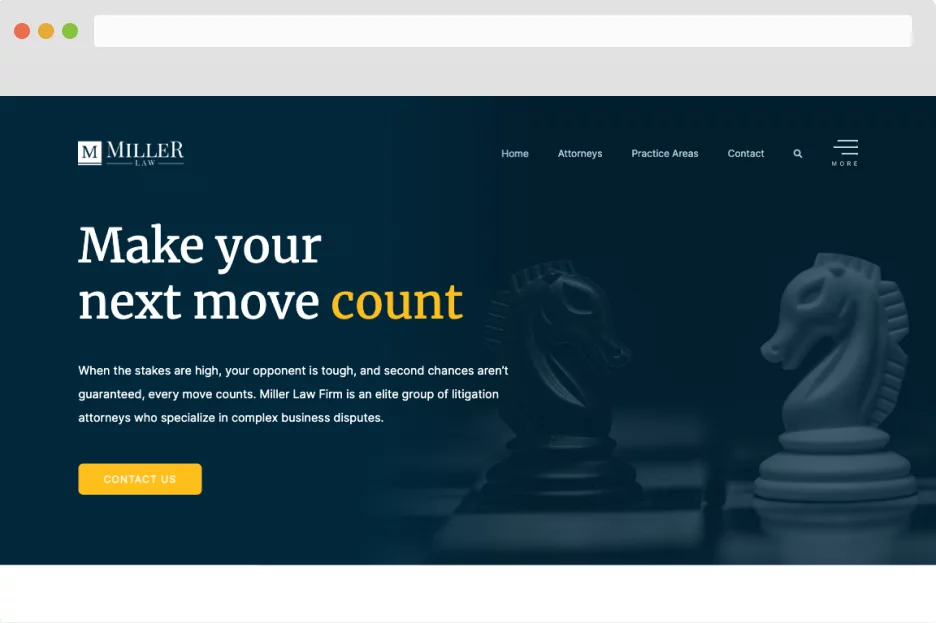

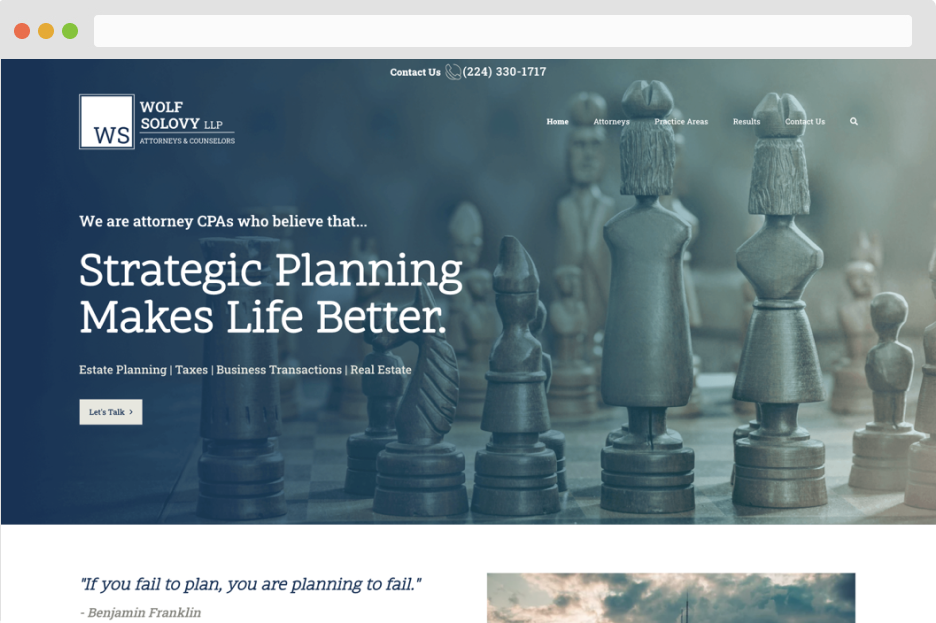

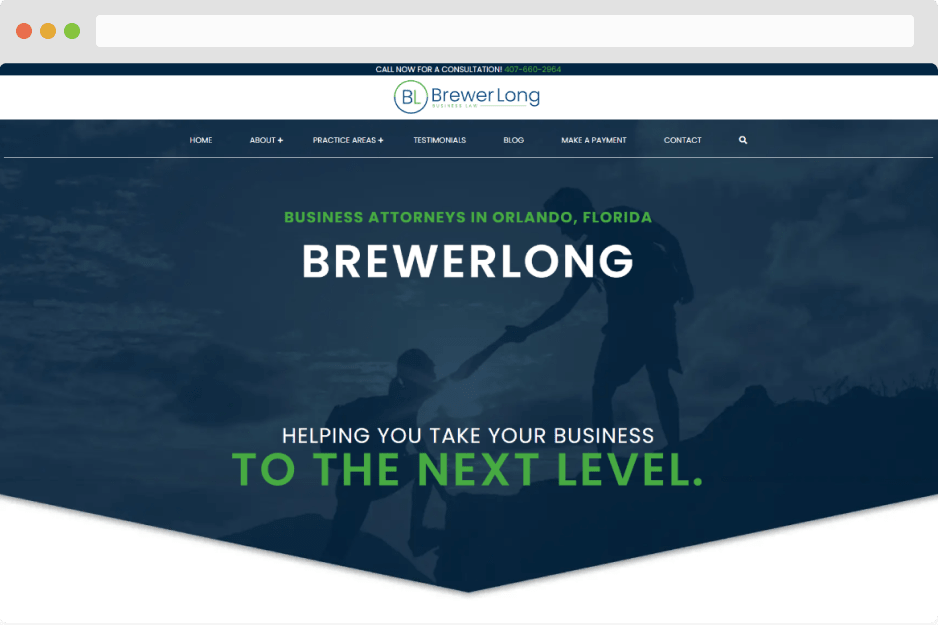

- Business Law

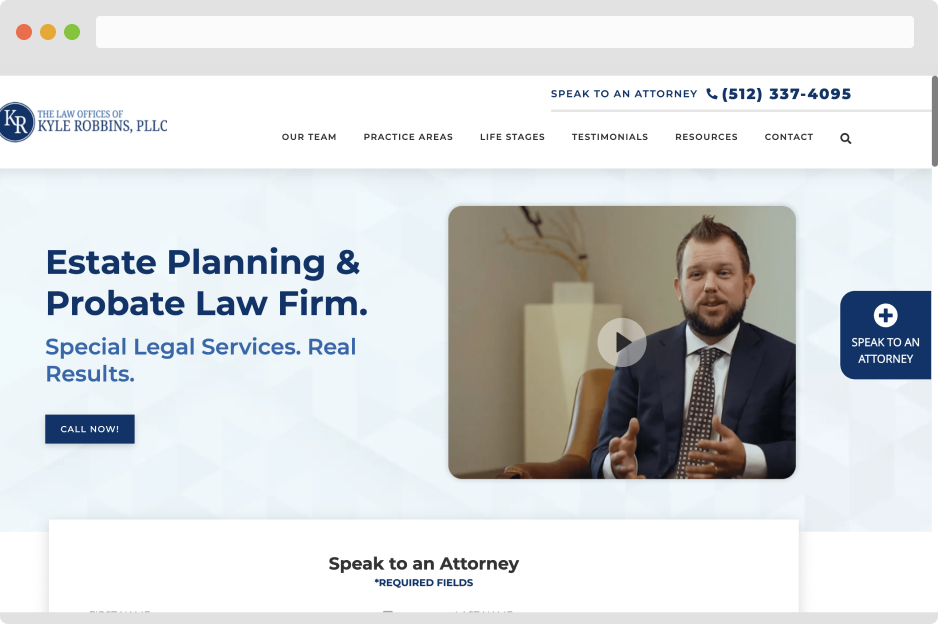

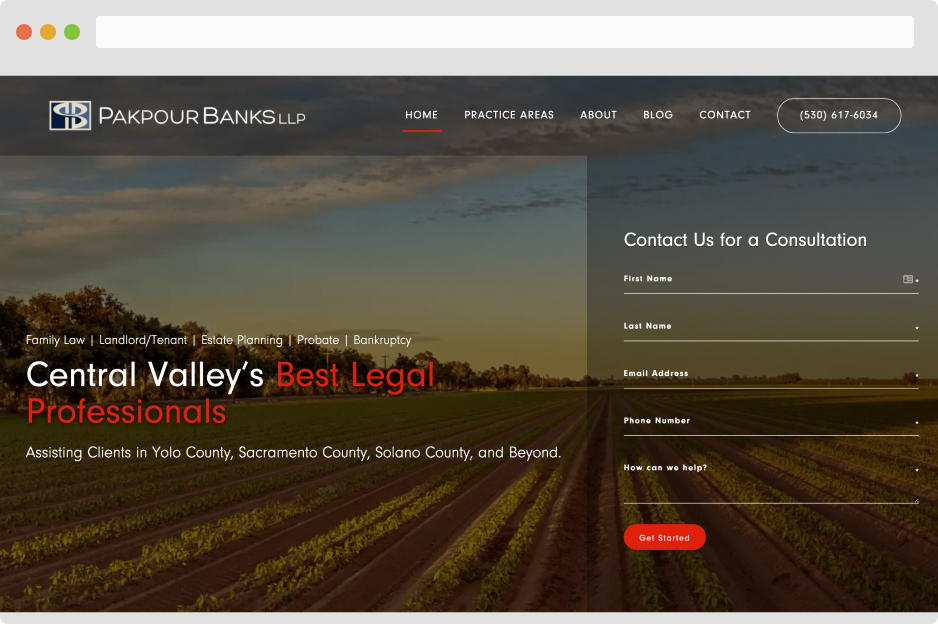

- Estate Planning

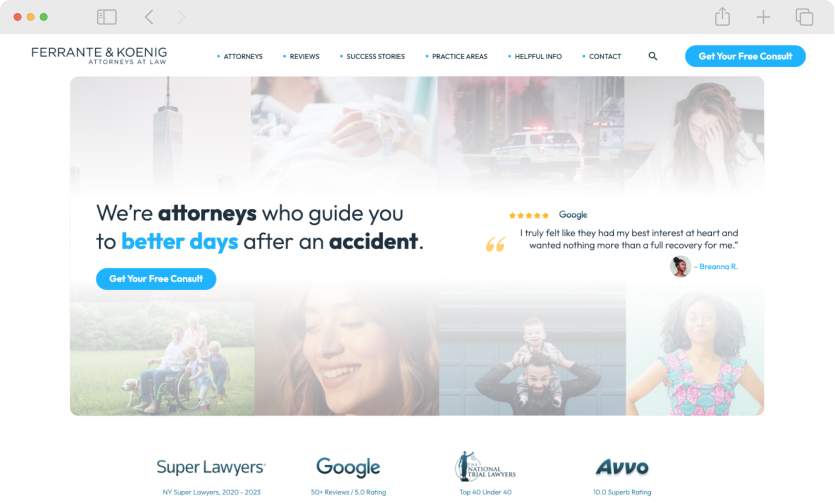

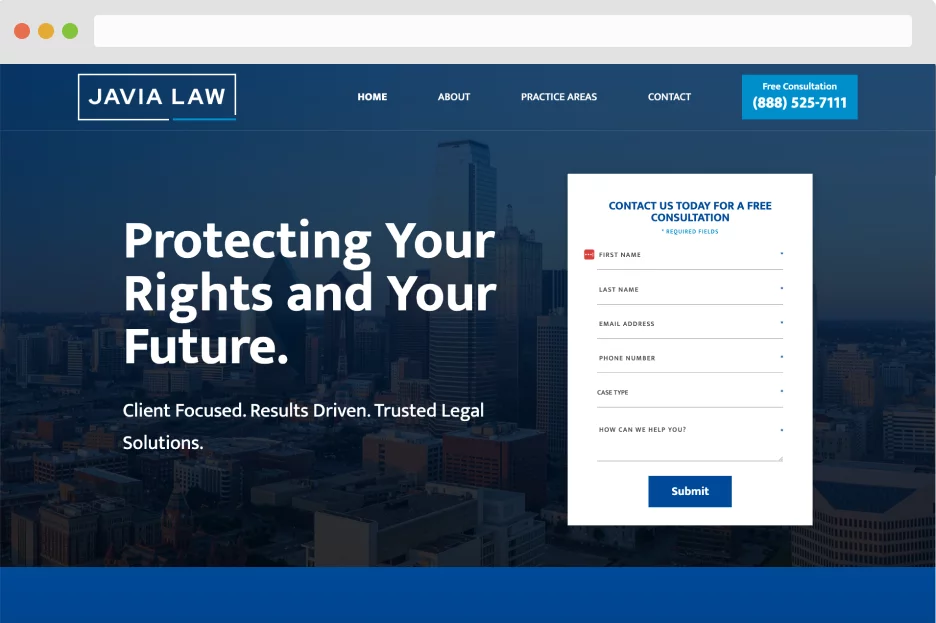

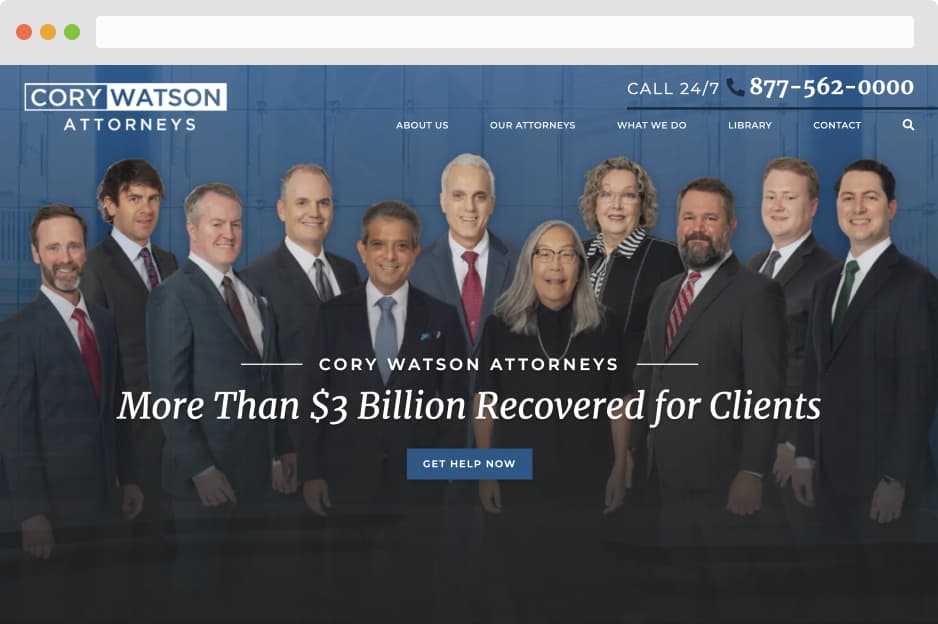

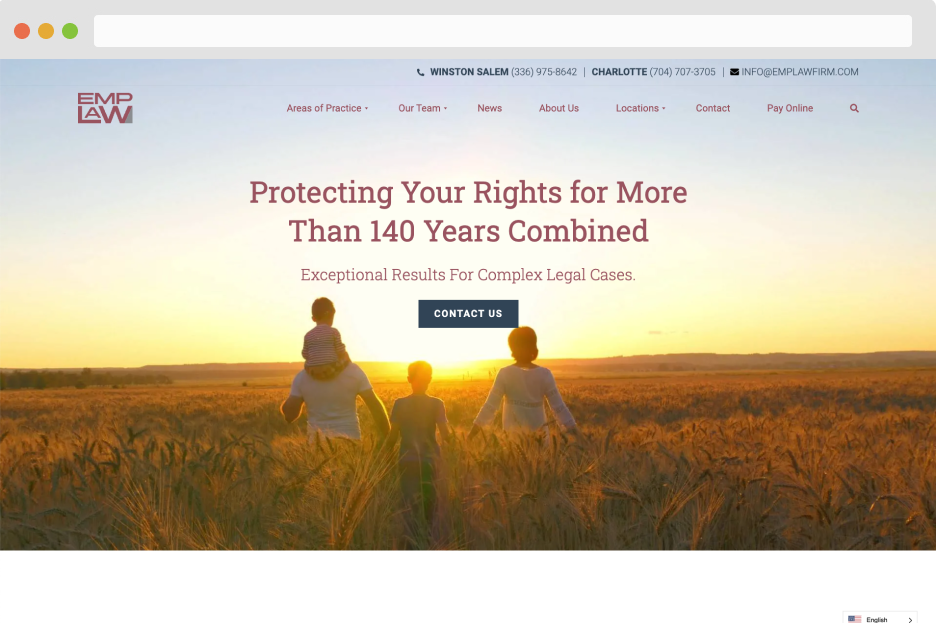

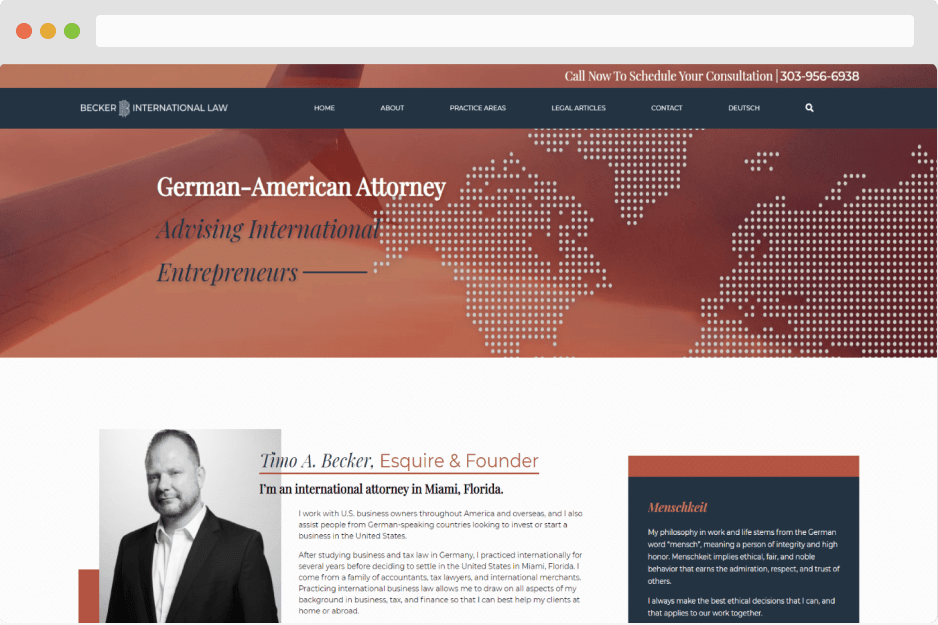

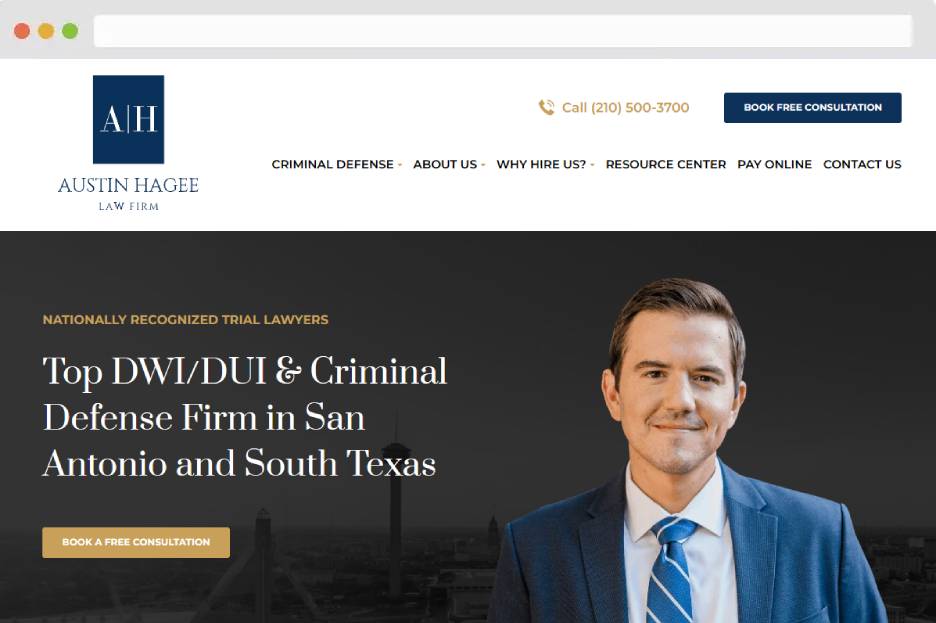

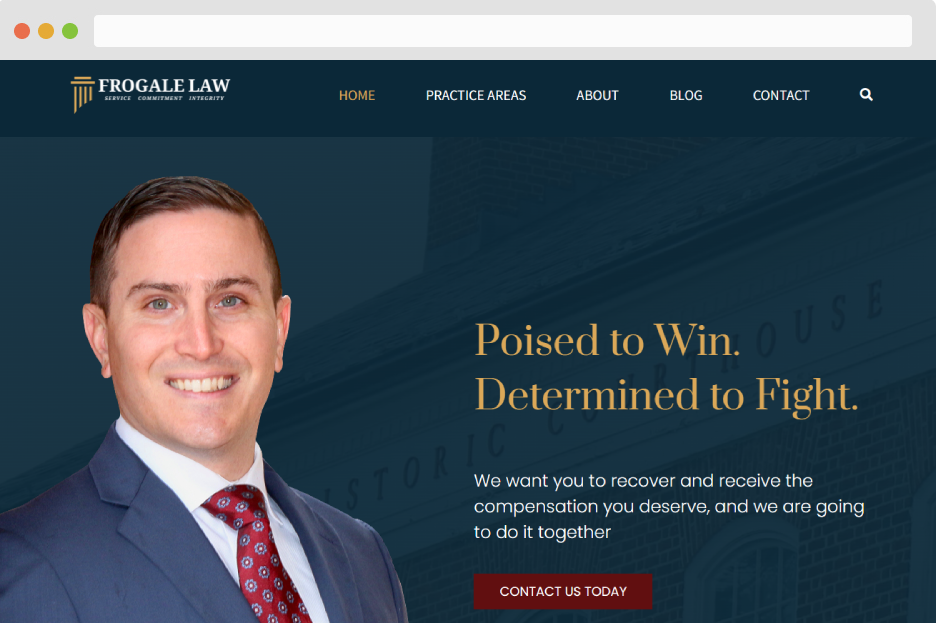

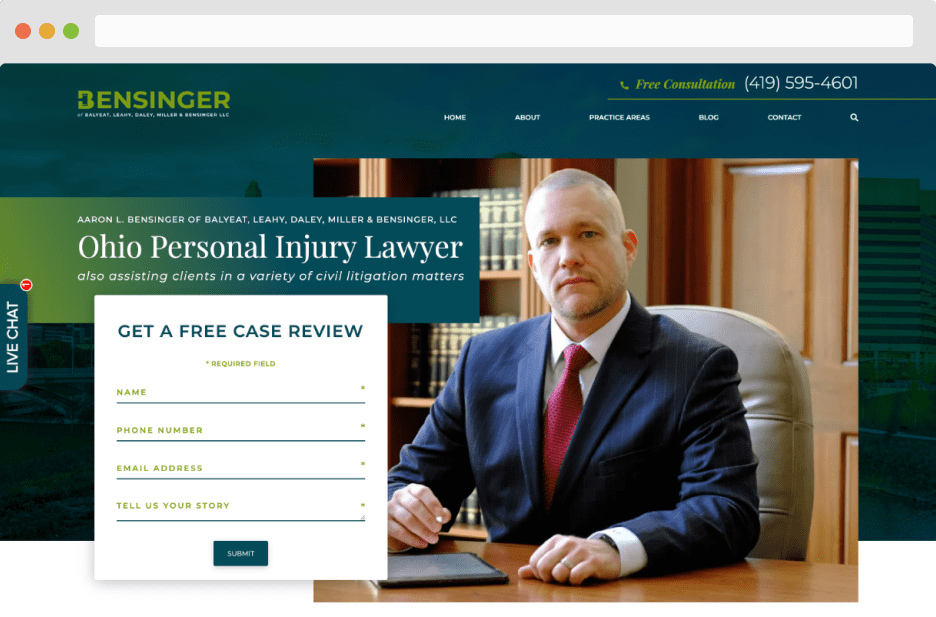

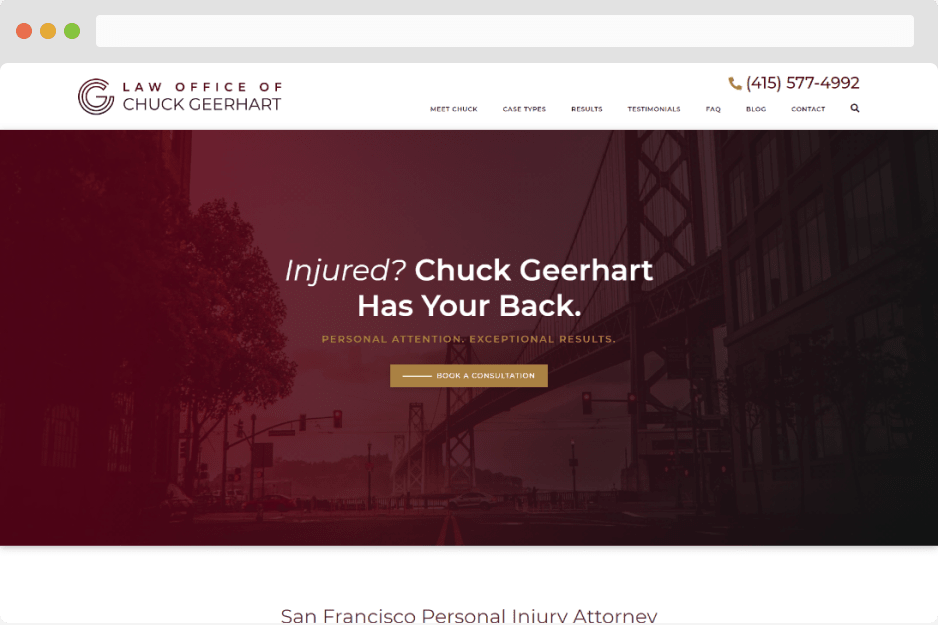

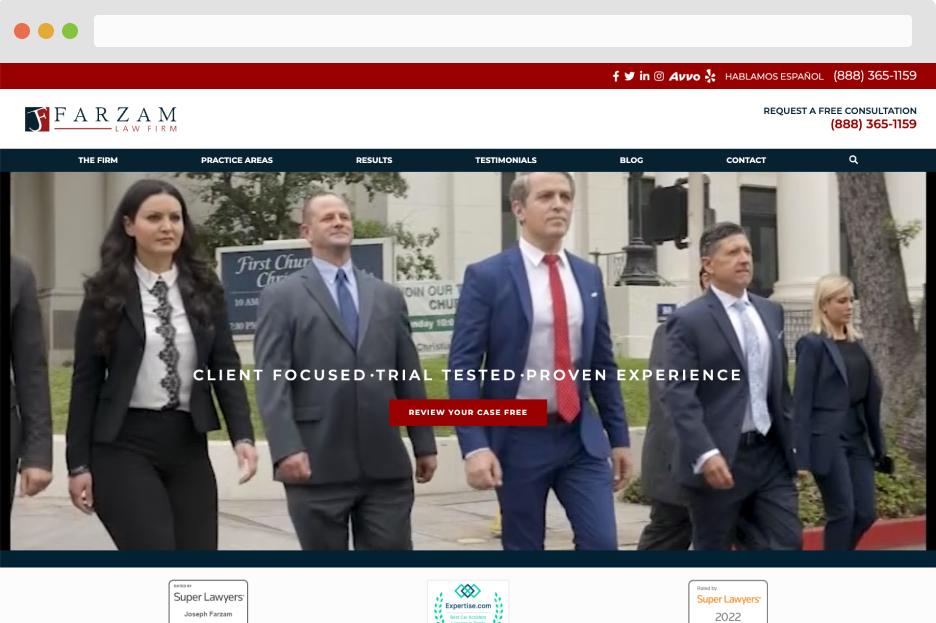

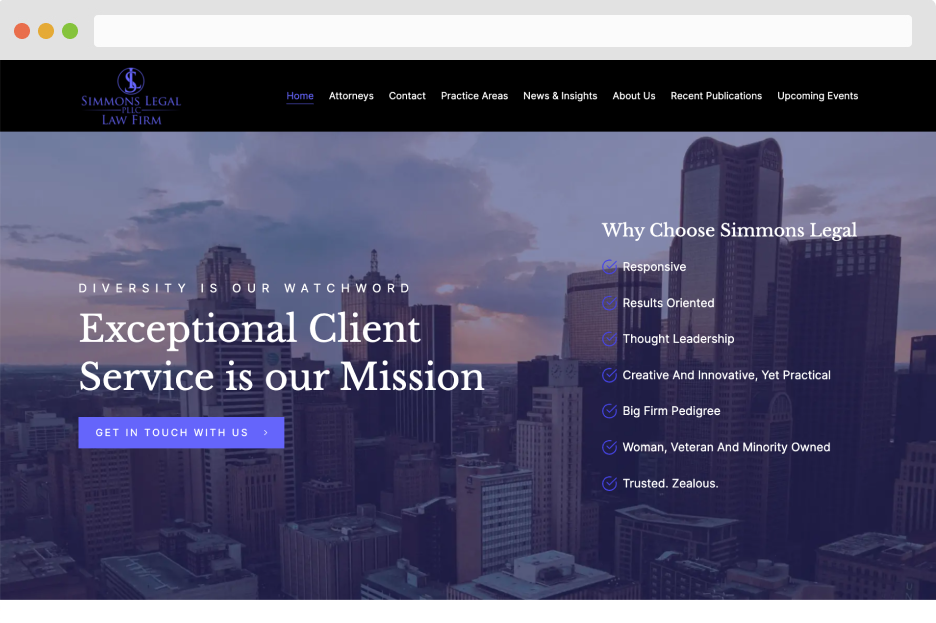

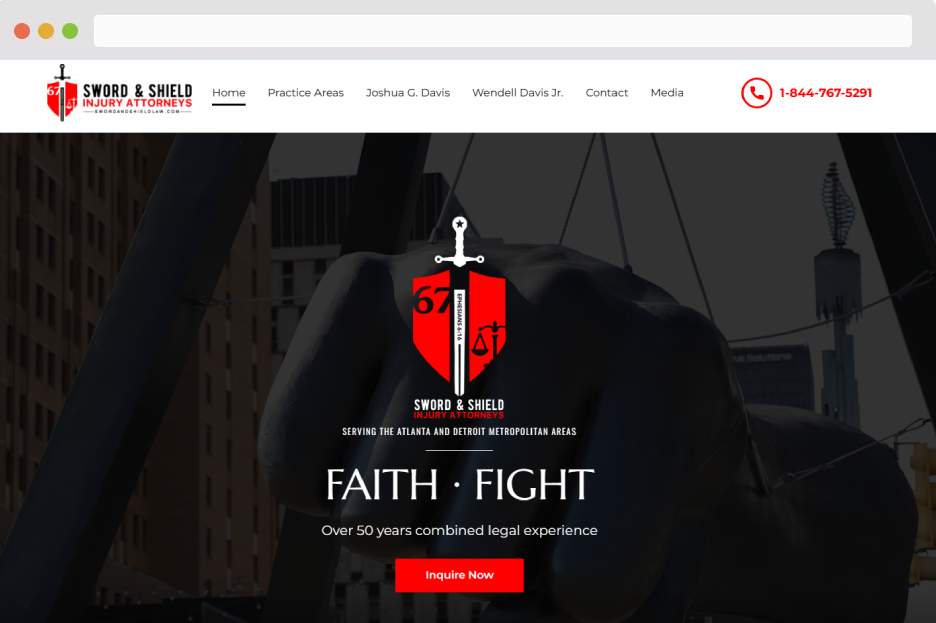

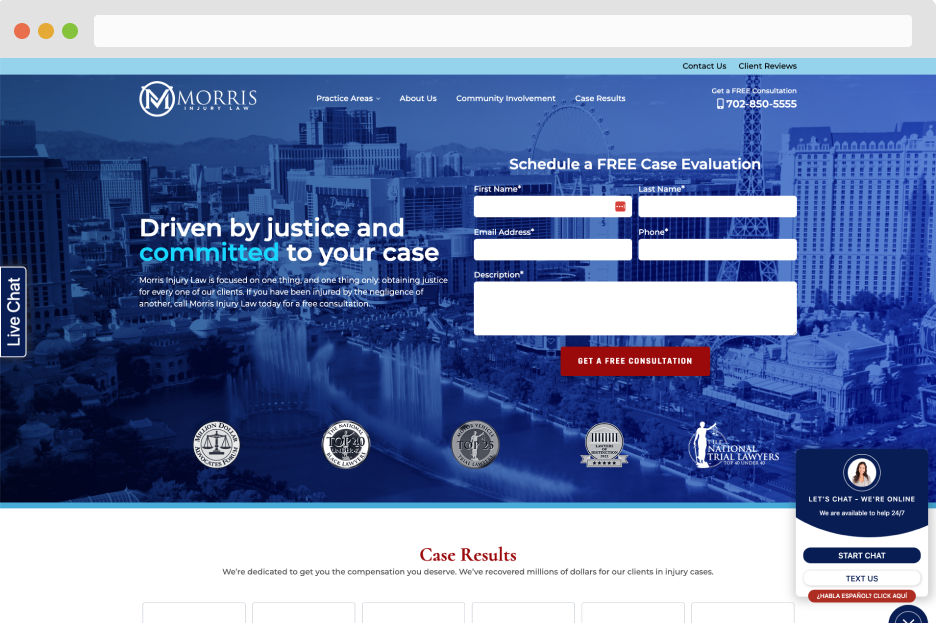

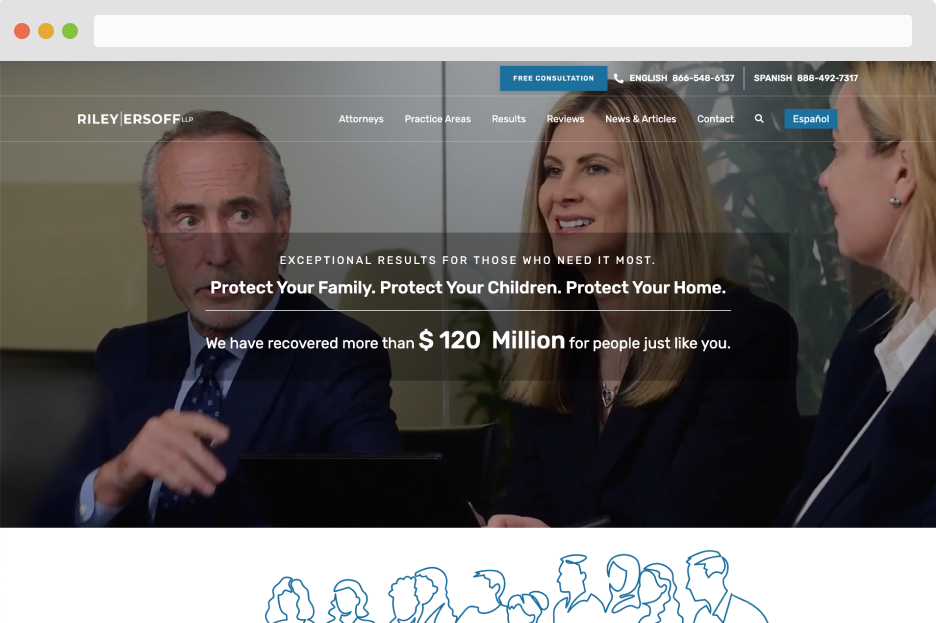

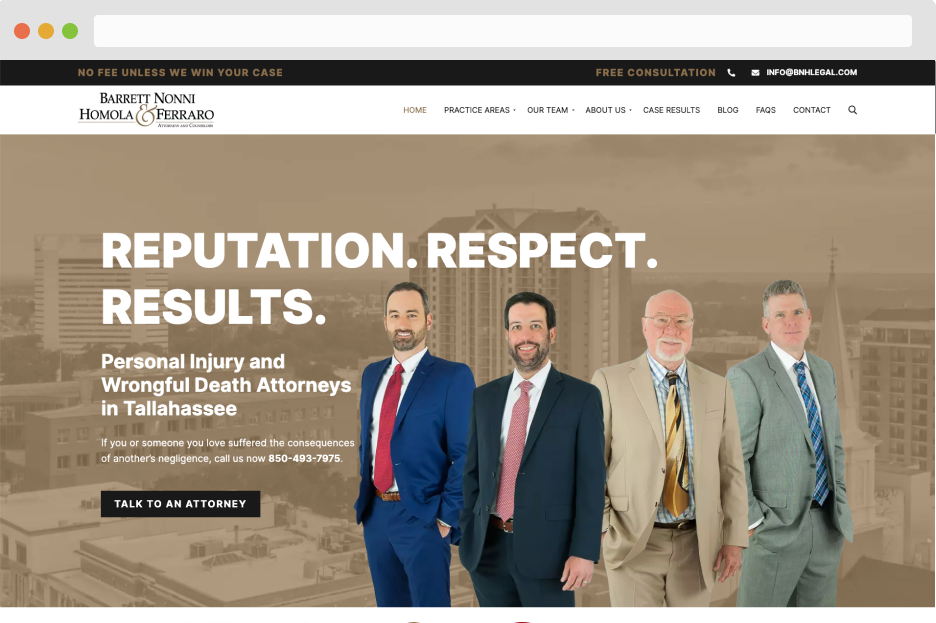

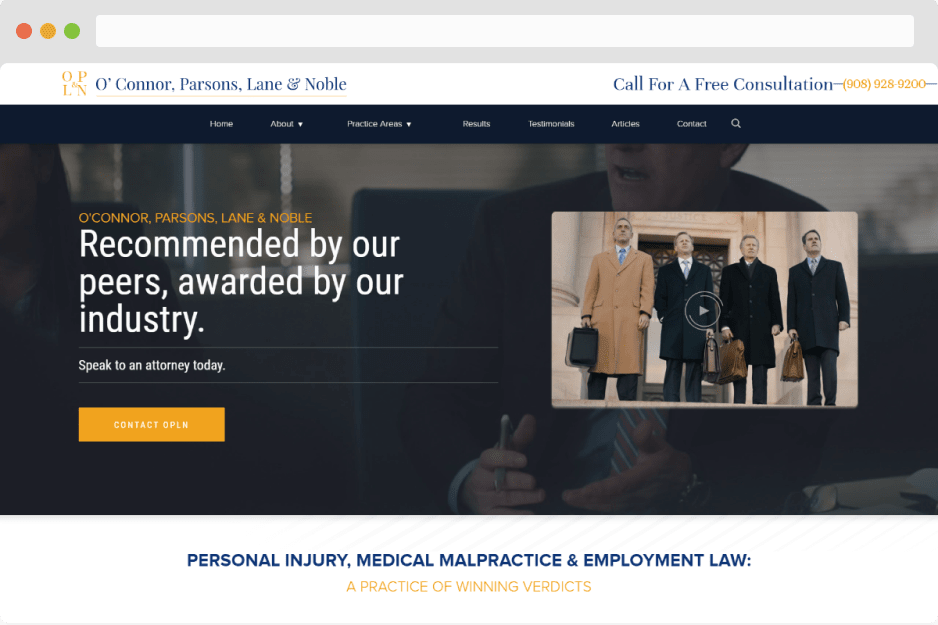

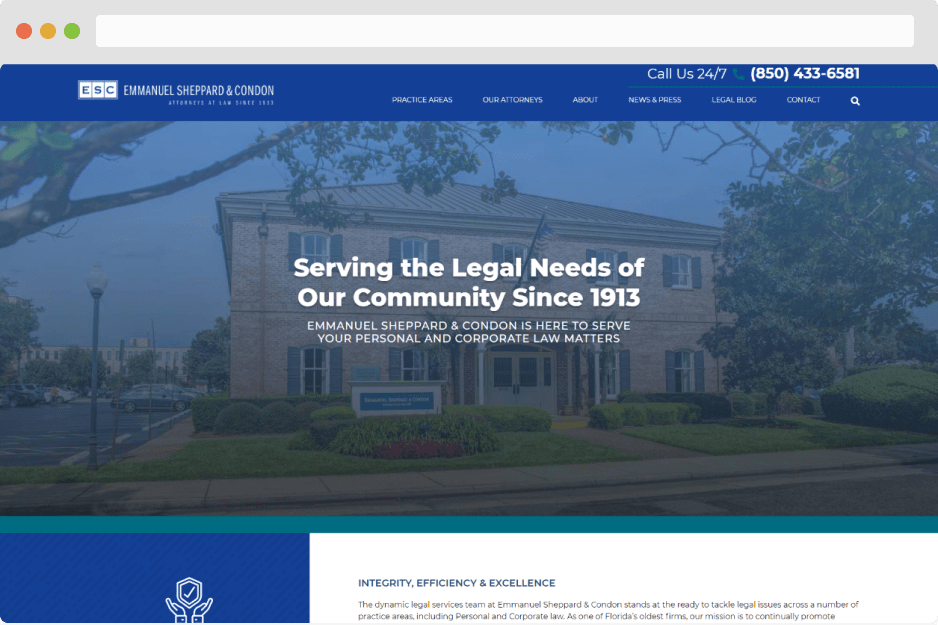

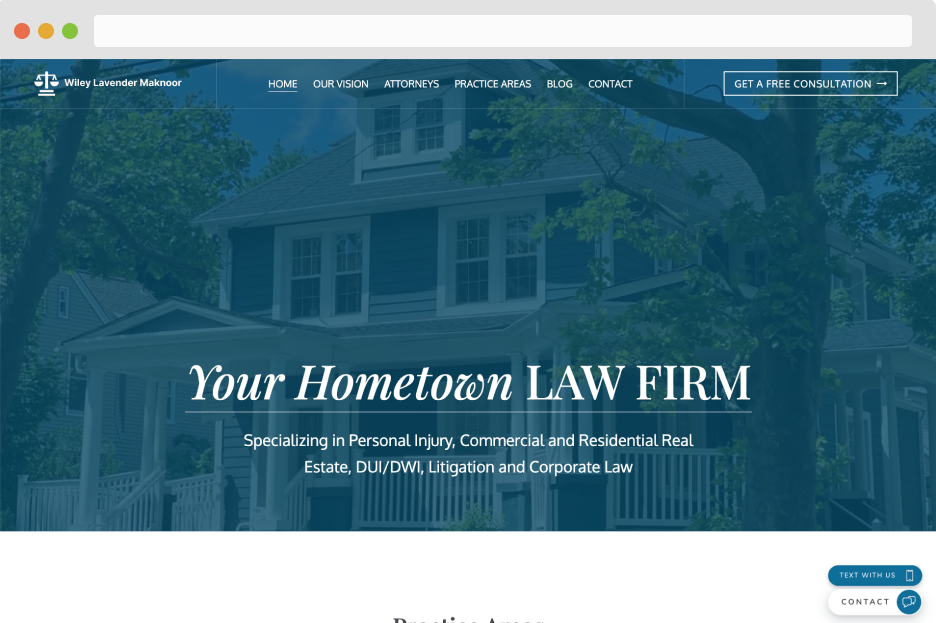

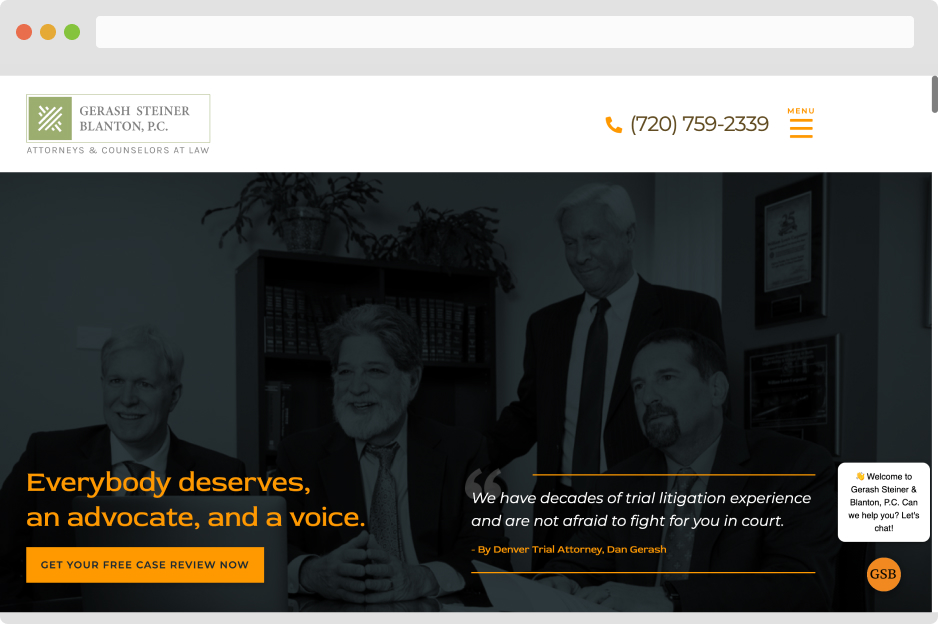

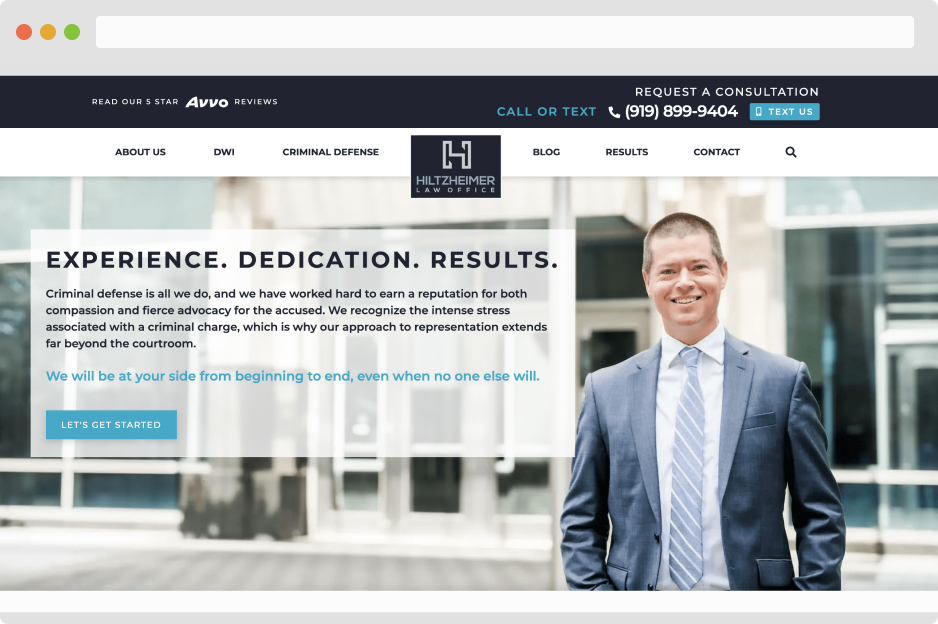

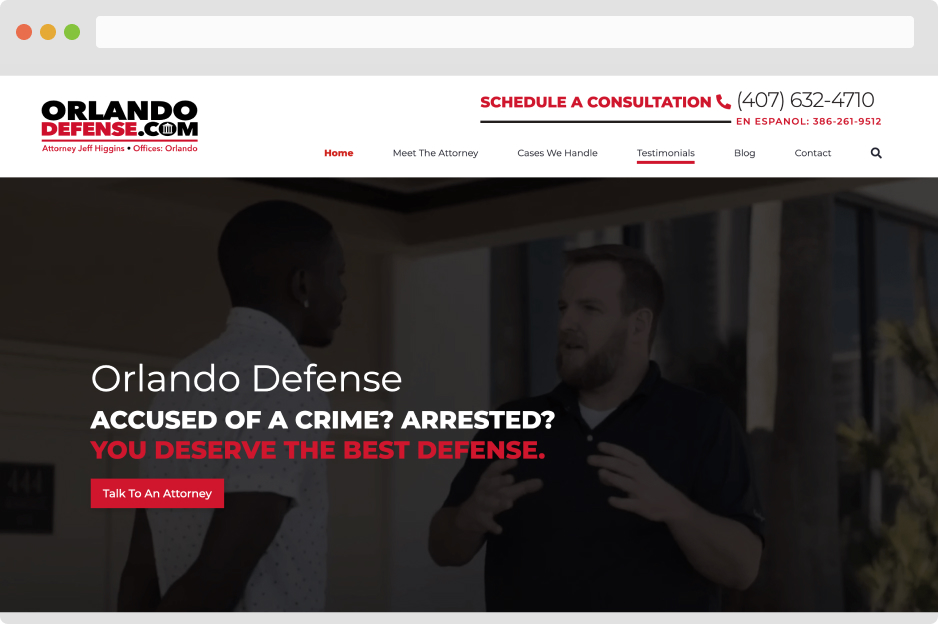

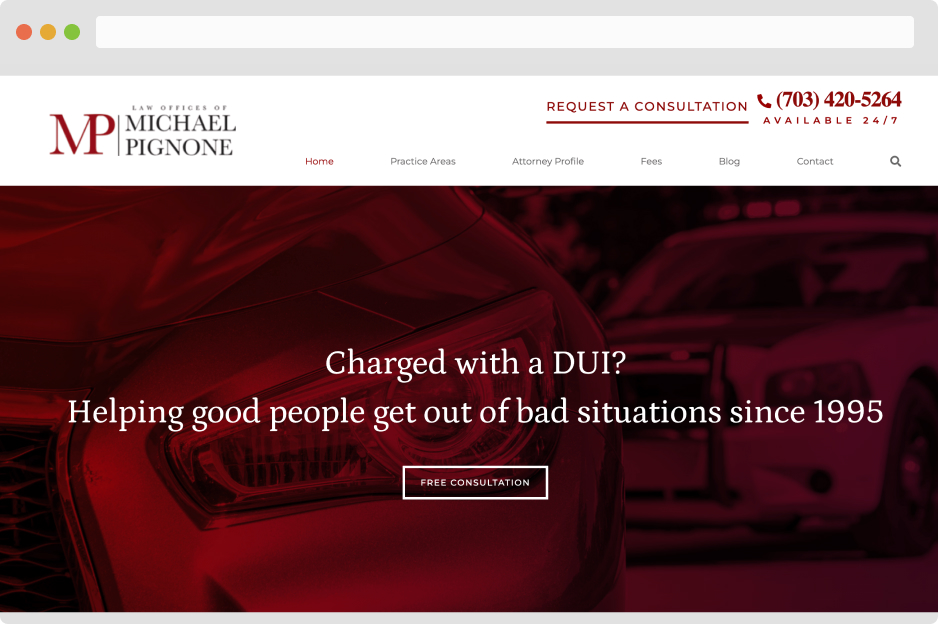

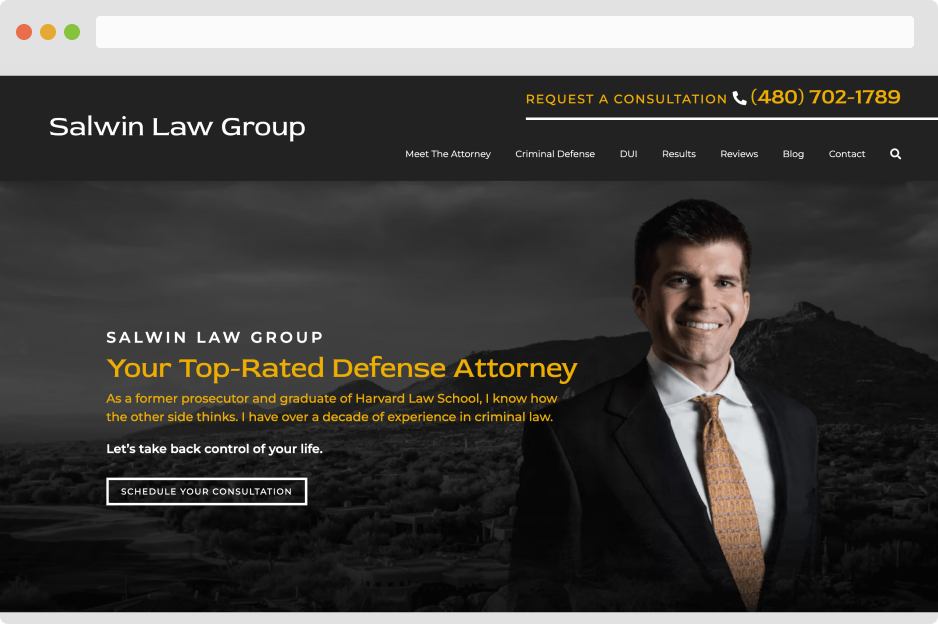

- Fully Custom Sites

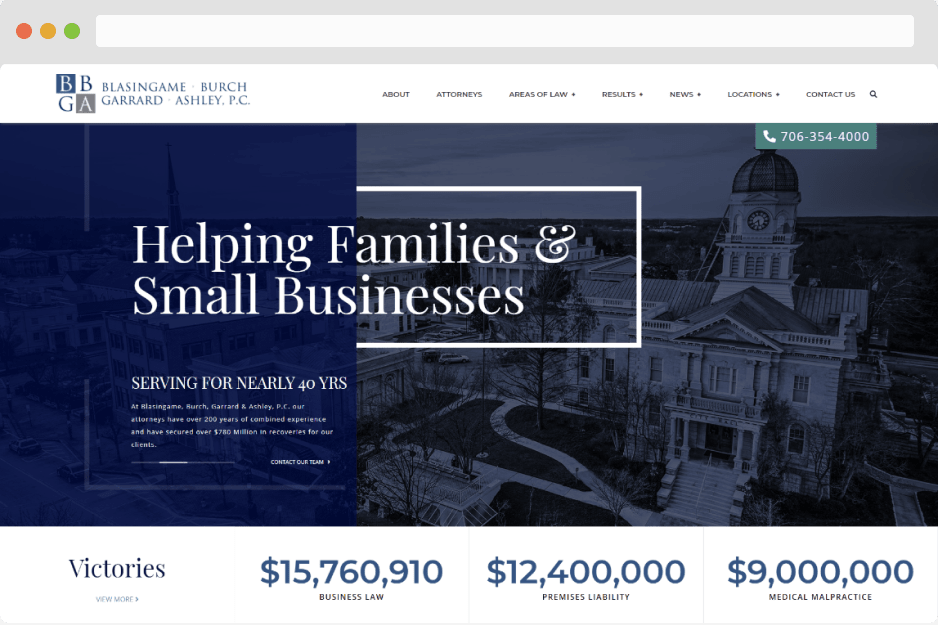

- Larger Law Firms

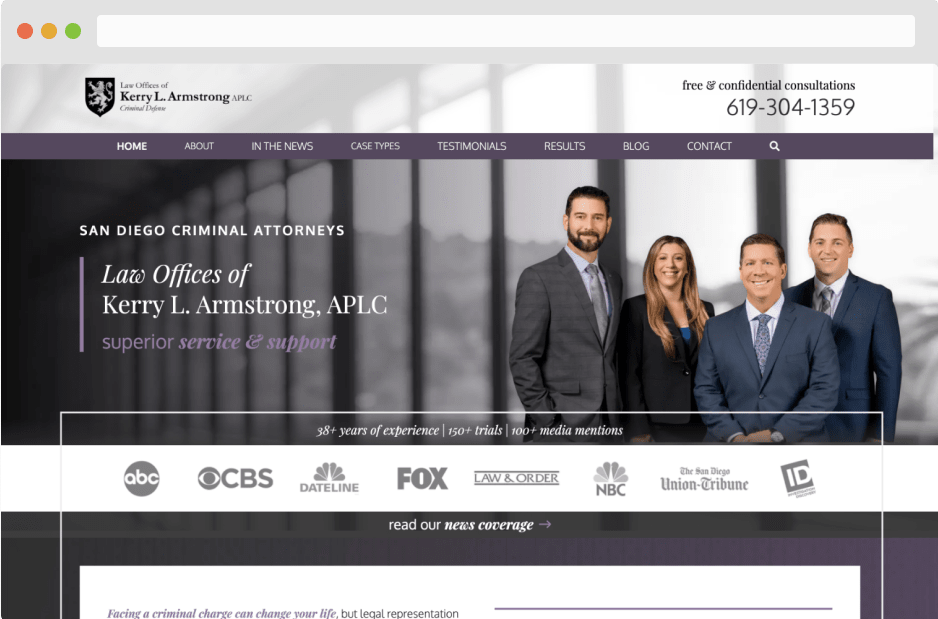

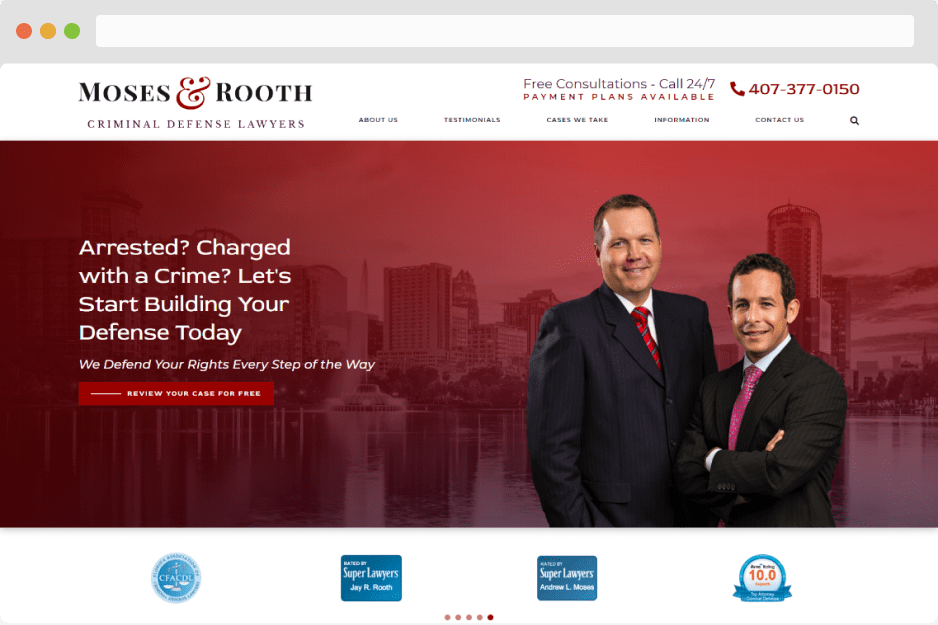

- Large Market Firms

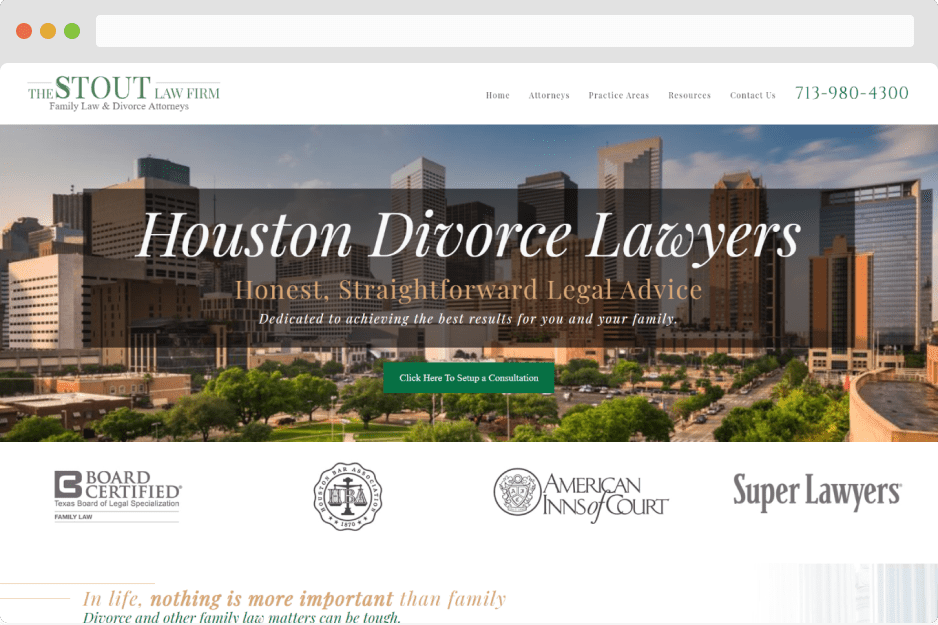

- Family Law

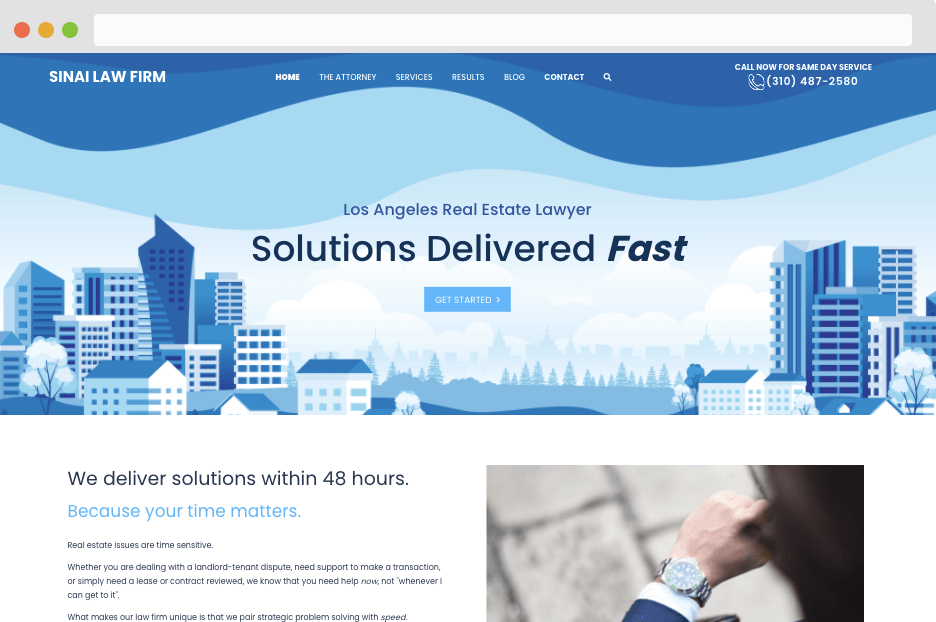

- Real Estate Law

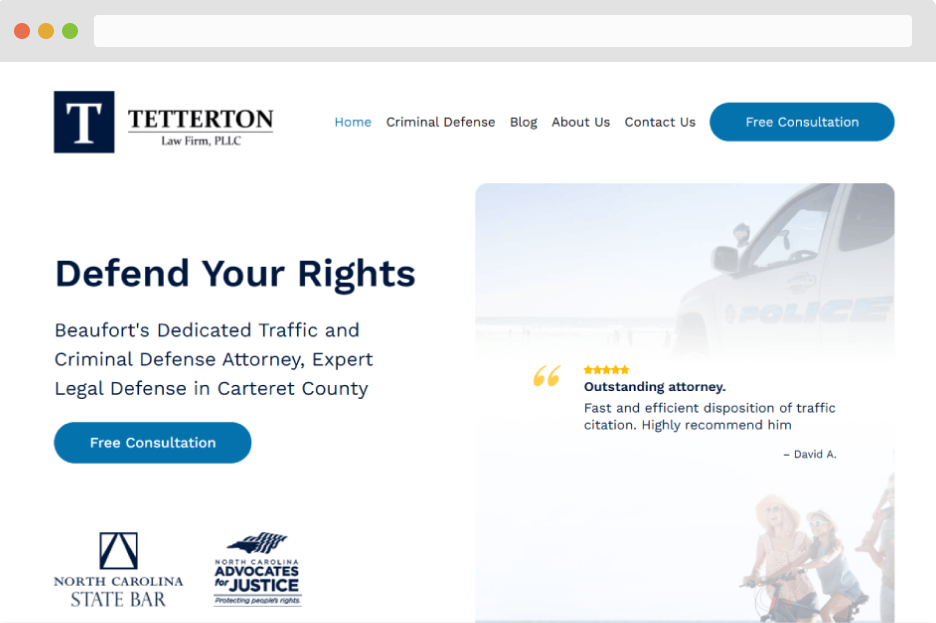

- Criminal Defense

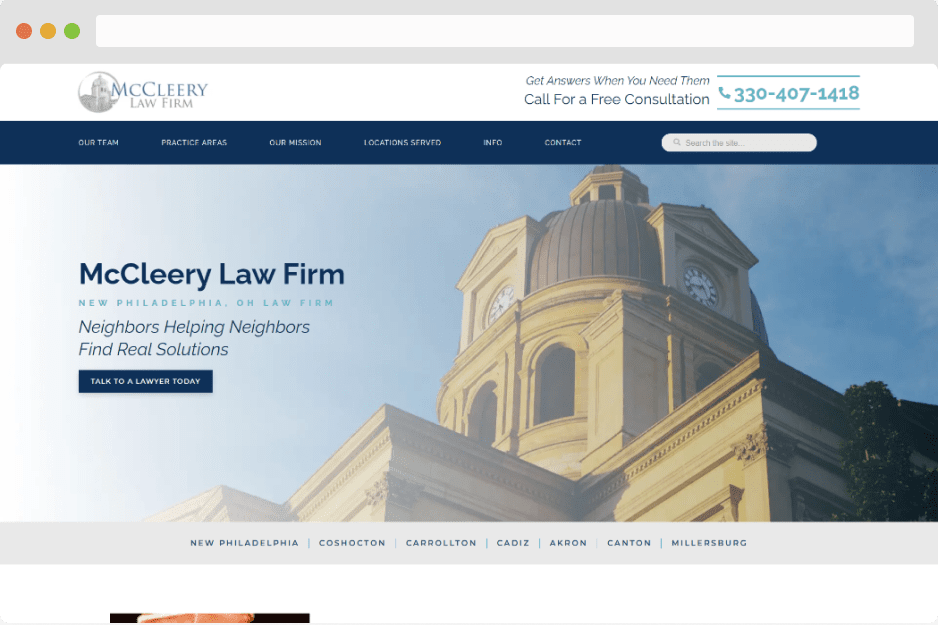

- Smaller Law Firms

- Custom Homepage Sites

- Small Market Firms

- 237% Organic Traffic

- 11 Qualified Leads Per Month

- Designed with StoryBrand